In 2025, compliance mapping tools are giving institutions clarity on how stablecoins align with global regulatory standards.

Why Compliance Defines Trust

Stablecoins are no longer just technical instruments—they are financial products under regulatory microscopes. For institutions managing billions, compliance is the dividing line between adoption and exclusion. Without alignment to global AML, KYC, and sanctions frameworks, stablecoins risk being sidelined from treasury systems and settlement networks.

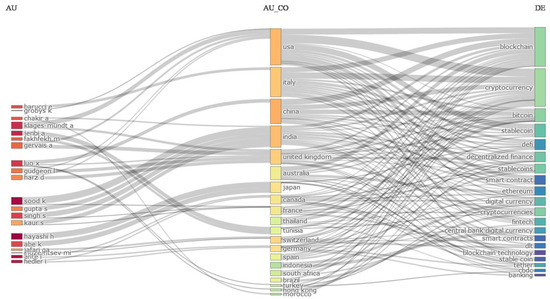

Compliance mapping has therefore emerged as a cornerstone of institutional analytics. By consolidating jurisdictional rules and on-chain data, these tools help institutions navigate an increasingly complex landscape.

Core Components of Compliance Mapping

Jurisdictional Rules

Dashboards integrate requirements from the U.S. Treasury, EU AML directives, and Asian regulatory frameworks.

Wallet Screening

All counterparties are mapped against sanctions and suspicious activity lists.

Transaction Monitoring

Analytics flag patterns suggesting money laundering, layering, or structuring.

Risk Scoring

Stablecoins are graded on their compliance readiness, giving institutions a clear benchmark.

Institutional Applications

Hedge Funds: Ensure counterparties and pools meet compliance thresholds before deploying capital.

Corporate Treasuries: Use compliance scores to decide which stablecoins can handle cross-border settlements.

Custodians: Provide regulator-ready compliance dashboards to clients.

Regulators: Demand ongoing compliance mapping reports from issuers and intermediaries.

Expert Commentary

Sarah Patel, Head of Compliance at Global Custody Bank:

“Institutions will not touch a stablecoin unless compliance data is mapped, scored, and regulator-ready.”

Dr. Omar Hassan, Policy Advisor:

“Compliance mapping is the passport of stablecoins. Without it, they cannot travel across borders.”

Case Studies

U.S. Hedge Fund: Avoided penalties by screening wallets through compliance maps that flagged exposure to sanctioned addresses.

European Corporate: Shifted reserves into a stablecoin with higher compliance scores, ensuring regulatory approval for supplier payments.

Tools Driving Compliance Mapping

On-chain forensics linking transactions to known entities.

AI-driven anomaly detection highlighting suspicious flows.

Cross-jurisdiction monitors updating compliance requirements in real time.

Role of Artificial Intelligence

AI strengthens compliance mapping by:

Automating wallet risk classification.

Forecasting exposure to sanctioned wallets.

Reducing false positives in monitoring systems.

Generating regulator-ready reports instantly.

The Institutional Playbook for 2025

Compliance mapping is more than risk avoidance—it is a competitive advantage. Institutions that deploy advanced compliance dashboards win regulator trust, attract clients, and expand across borders. Issuers that fail to align risk being excluded from mainstream finance.

The Bottom Line

Stablecoin adoption is no longer just about liquidity and reserves. In 2025, compliance mapping defines credibility. By standardizing regulatory readiness, these tools transform stablecoins from risky innovations into trusted financial instruments.