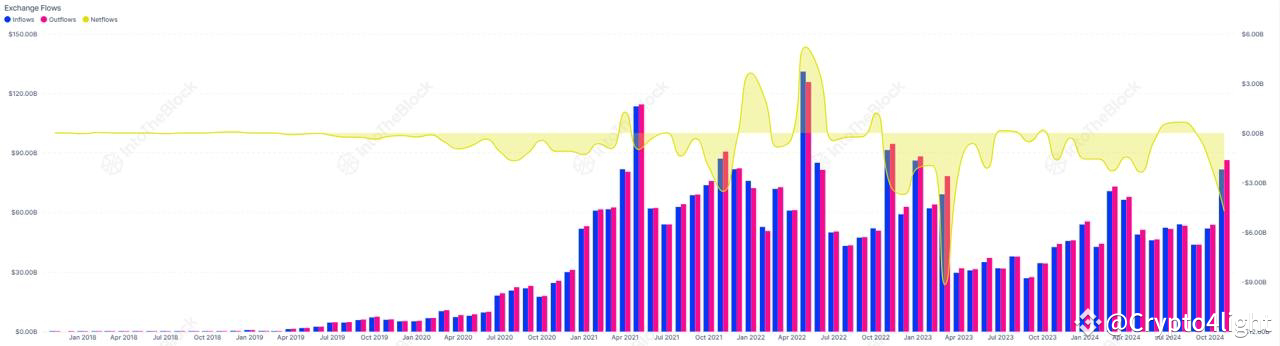

Tracking exchange inflows and outflows has become one of the most reliable indicators of institutional sentiment in the stablecoin market.

Why Exchange Flows Matter

In traditional finance, analysts watch deposit and withdrawal data to measure liquidity and investor confidence. For stablecoins in 2025, exchange flows serve the same purpose. When billions of tokens move into or out of exchanges, they reveal how institutions are positioning themselves for risk, settlement, or speculation.

Monitoring these flows is now standard practice for hedge funds, corporates, and regulators seeking early signals of market shifts.

Key Patterns in 2025

Inflows to Exchanges

Often precede selloffs, as institutions prepare to convert stablecoins into volatile assets or fiat.

Can indicate treasury activity when corporates deploy reserves for cross-border settlements.

Outflows to Custody

Suggest risk-off positioning, as funds move tokens to insured custodial wallets.

Reflect long-term holding strategies during uncertain markets.

Flows Into DeFi

Point to yield-seeking behavior, with stablecoins redirected into lending pools or automated market makers.

Institutional Applications

Hedge Funds

Use exchange flow data to anticipate volatility and hedge exposures.

Corporate Treasuries

Track flows to forecast settlement costs and liquidity bottlenecks.

Custodians

Monitor client behavior, balancing between inflows for trading and outflows for long-term reserves.

Regulators

View exchange flows as systemic indicators, particularly during redemption waves.

Expert Commentary

Dr. Hannah Kim, Blockchain Policy Analyst:

“Exchange flows are the canary in the coal mine. Institutions that ignore them risk missing the first signs of instability.”

James O’Connor, DeFi Risk Manager:

“When inflows surge, we know liquidity is about to shift. Outflows, meanwhile, tell us institutions are bracing for stress.”

Case Studies

March 2025 Market Event: A sudden $12 billion inflow into major exchanges foreshadowed a crypto selloff, giving hedge funds an early warning.

European Corporate Activity: Outflows from exchanges to custody wallets signaled defensive treasury strategies during euro-dollar volatility.

Tools for Tracking Exchange Flows

On-chain dashboards aggregating inflows and outflows across major platforms.

AI-driven alerts flagging abnormal surges or drops in flows.

Compliance filters screening exchange transfers against AML standards.

Role of Artificial Intelligence

AI enhances flow monitoring by:

Predicting price volatility based on inflow spikes.

Detecting anomalies that suggest manipulation or whale activity.

Automating cross-exchange comparisons for institutional dashboards.

Forecasting settlement bottlenecks in high-volume corridors.

The Bottom Line

Exchange flows are no longer retail curiosities; they are institutional signals. In 2025, monitoring inflows and outflows provides early insight into liquidity, sentiment, and systemic risks. Institutions that integrate exchange flow data into their strategies gain a decisive edge in navigating volatile stablecoin markets.