Governance models determine the transparency, accountability, and resilience of stablecoins, shaping how institutions evaluate long-term trust.

Introduction

Stablecoins have become systemic to both decentralized finance (DeFi) and institutional liquidity systems. But beyond peg mechanics and reserves, their true resilience depends on governance. Governance defines who makes decisions, how conflicts are resolved, and what level of transparency stakeholders can expect.

For institutions managing billions, governance is not a side consideration. It is central to oversight. Weak governance exposes portfolios to risks of mismanagement, opaque decision-making, and regulatory intervention. Strong governance provides predictability, trust, and alignment with compliance frameworks.

This guide explores the major governance models in stablecoin markets, their strengths and weaknesses, and how institutions can evaluate them for oversight.

Why Governance Matters

Accountability

Governance determines who is responsible for decisions and how they are enforced.

Transparency

Clear governance structures ensure reserves, audits, and policies are disclosed consistently.

Risk Management

Decentralized but effective governance reduces single points of failure.

Institutional Trust

Boards and regulators demand governance clarity before approving allocations.

Major Governance Models in Stablecoin Markets

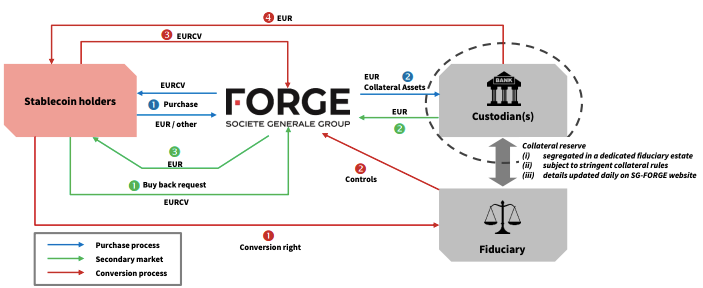

1. Centralized Issuer Governance

In this model, a single company or consortium manages issuance, reserves, and redemption.

Strengths: Clear accountability, regulatory compliance, fast decision-making.

Weaknesses: Opaque operations, concentration of power, vulnerability to enforcement actions.

2. Decentralized DAO Governance

Governance is distributed among token holders or delegates through voting systems.

Strengths: Transparency, community participation, reduced concentration risk.

Weaknesses: Slow decision-making, risk of voter apathy, susceptibility to whale dominance.

3. Hybrid Models

Some stablecoins blend centralized oversight with decentralized input. For example, issuers may manage reserves while governance tokens determine risk parameters.

Strengths: Balance of efficiency and transparency.

Weaknesses: Complexity, blurred accountability.

Key Governance Features Institutions Evaluate

Reserve Transparency

Governance must enforce regular, independent audits of reserves.

Decision-Making Processes

Institutions assess whether governance allows rapid yet accountable responses to crises.

Conflict Resolution Mechanisms

Clear systems for disputes prevent destabilization.

Regulatory Alignment

Governance frameworks that align with compliance standards increase institutional trust.

Voter Participation Metrics

In DAO systems, institutions monitor voter turnout and concentration of influence.

Institutional Applications of Governance Oversight

Portfolio Allocation

Institutions prefer stablecoins with strong governance, integrating governance scores into risk dashboards.

Risk Committees

Governance models inform how risk officers set allocation limits and approve exposures.

Regulatory Reporting

Governance frameworks become part of disclosures to regulators and boards.

Custodial Partnerships

Custodians require governance clarity before offering insured accounts.

The Role of Artificial Intelligence in Governance Analysis

AI strengthens institutional oversight by:

Tracking governance votes in real time.

Detecting whale dominance in DAO models.

Forecasting decision outcomes based on historical behavior.

Evaluating the transparency of reserve disclosures automatically.

AI ensures institutions monitor governance continuously rather than episodically.

Case Studies

Centralized Issuer Transparency

Issuers providing frequent audits gained institutional trust, increasing adoption.

DAO Governance Disputes

Protocols with poor voter participation faced crises when decisions stalled, highlighting risks of weak governance.

Hybrid Governance Resilience

Hybrid systems balanced compliance with decentralization, enabling institutions to allocate capital with confidence.

Challenges in Governance Models

Concentration Risk

Even DAOs may face whale dominance if large holders control votes.

Regulatory Uncertainty

Governance models may not align with evolving frameworks.

Operational Inefficiency

Decentralized decision-making can delay critical responses.

Transparency Gaps

Some issuers lack clear disclosure practices despite claiming strong governance.

Best Practices for Institutions

Evaluate Governance Scores

Use benchmarks that measure transparency, participation, and accountability.

Diversify Across Models

Avoid concentration by holding stablecoins with different governance systems.

Integrate Into Dashboards

Track governance indicators alongside liquidity and compliance metrics.

Engage Actively

Where possible, participate in governance processes to influence outcomes.

The Future of Stablecoin Governance

By 2025 and beyond, governance will become a central pillar of regulatory oversight. Expect:

Global frameworks defining minimum governance standards.

AI-driven monitoring to ensure transparency and accountability.

Hybrid models dominating as institutions demand both compliance and decentralization.

Mandatory governance disclosures in regulatory audits.

Governance is not an abstract issue. It is the foundation of institutional trust in stablecoin markets.