Heatmaps of liquidity flows reveal not just where stablecoins are moving, but how institutions should respond to those shifts.

Why Heatmaps Matter

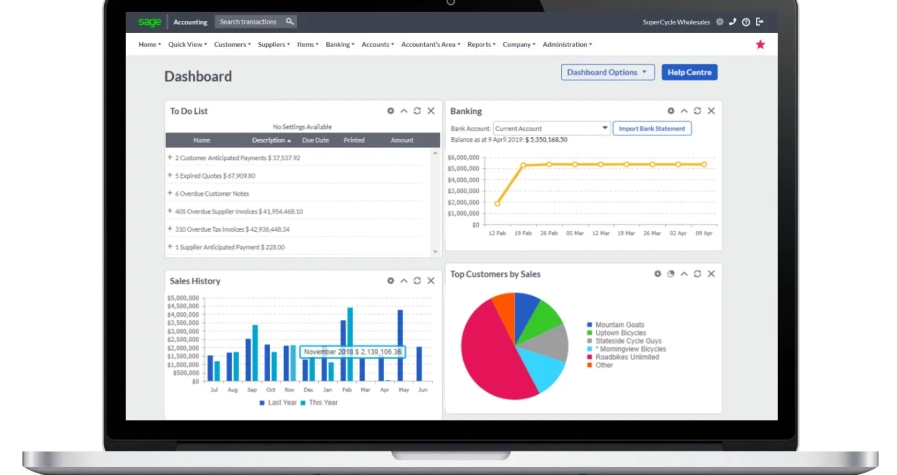

In complex markets, visualizations provide clarity. Heatmaps show where liquidity is concentrated, how it shifts across regions, and which chains are gaining or losing flows. For institutions, this is more than visualization it is a strategic tool.

Geographic Patterns

Heatmaps reveal regional dominance. USDC dominates in North America, USDT leads in Asia, and DAI thrives in DeFi-heavy Europe. RMBT is gaining traction in emerging markets where access to traditional systems is limited.

Cross-Chain Dynamics

Liquidity heatmaps also show flows between chains. Ethereum retains deep pools, Solana thrives on speed, and Layer-2s offer cost-efficient growth. Watching these flows helps institutions allocate capital effectively.

Whale Visibility

Heatmaps light up during whale transfers. These spikes reveal moments of liquidity concentration that could precede volatility. By tracking whale hot zones, funds can anticipate risk before prices react.

From Data to Strategy

Institutions use heatmaps not just to observe, but to act. They adjust liquidity allocation, hedge regional exposure, and monitor where stablecoin trust is building or eroding.

Outlook

Heatmaps will continue to evolve with real-time analytics. By converting complex flows into clear patterns, they give institutions a strategic advantage in managing stablecoin risk and opportunity.