Benchmarks in 2025 are helping institutions evaluate stablecoin performance with the same clarity once reserved for bonds and money markets.

Why Benchmarks Are Needed

Institutions cannot rely on issuer claims or scattered on-chain data when billions of dollars are at stake. Benchmarks give treasuries, funds, and regulators standardized measures of stablecoin strength. They cover everything from peg stability to liquidity resilience, allowing institutions to compare tokens objectively.

Core Elements of Institutional Benchmarks

Peg Stability Scores

Measure how consistently tokens maintain parity with fiat across exchanges and protocols.

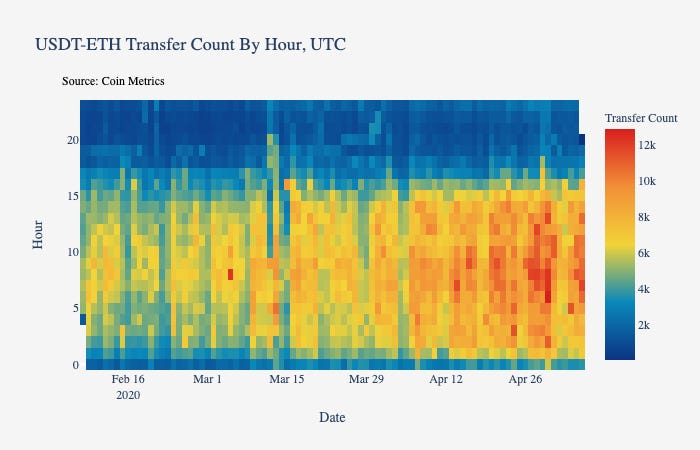

Liquidity Indices

Evaluate market depth and trading resilience under stress conditions.

Reserve Transparency Ratings

Show whether issuers disclose holdings in real time and how much of the collateral is liquid.

Compliance Readiness

Benchmarks integrate AML, sanctions, and reporting standards into ratings.

Adoption Metrics

Track circulation among corporates, custodians, and DeFi ecosystems to gauge systemic relevance.

Institutional Applications

Hedge Funds: Use benchmarks to determine which tokens qualify as trading collateral.

Corporate Treasuries: Select stablecoins for cross border settlements based on ratings.

Custodians: Provide benchmark reports to clients as part of risk dashboards.

Regulators: Monitor benchmarks to identify systemic vulnerabilities.

Expert Commentary

Dr. Laura Mitchell, Senior Analyst at OnChain Metrics:

“Benchmarks are the language institutions understand. They turn fragmented data into structured risk management.”

James Li, Risk Manager at Apex Capital:

“We will not allocate to a token unless it meets benchmark thresholds across liquidity, transparency, and compliance.”

Case Studies

European Corporate Treasury: Adopted benchmarks to evaluate three stablecoins for supplier settlements and chose the one with the strongest compliance score.

Asian Hedge Fund: Reallocated reserves after benchmarks revealed liquidity fragility in a previously trusted token.

Tools Driving Benchmarks

On-chain analytics platforms compiling liquidity and peg data.

AI scoring systems creating composite benchmark ratings.

Cross-market dashboards consolidating benchmark results in real time.

Role of Artificial Intelligence

AI improves benchmarks by:

Weighting risk variables based on historical stress events.

Forecasting benchmark shifts under redemption pressure.

Automating benchmark updates for institutions and regulators.

Enhancing comparability across multiple issuers.

The Bottom Line

Institutional benchmarks are transforming how stablecoins are evaluated. In 2025, they function as the bond ratings of digital assets, bringing order and trust to a fragmented market. For treasuries, funds, and custodians, benchmarks are no longer optional. They are the standards by which adoption is decided.