Introduction

The stablecoin market has experienced a remarkable surge in 2025, reaching a valuation of $300 billion. This growth is attributed to several factors, including increasing institutional adoption, evolving regulatory clarity, and advancements in blockchain technology. Stablecoins are now integral to the operations of banks, fintech firms, and large corporates, providing predictable liquidity and enabling faster, more efficient transactions. This blog explores the key drivers of market expansion, regional adoption trends, regulatory frameworks, and implications for institutions and the broader financial ecosystem.

Factors Driving Market Growth

1. Institutional Adoption

Institutional investors are increasingly integrating stablecoins into their treasury operations to mitigate volatility and optimize liquidity management. Large banks and hedge funds are deploying USDC, USDT, and DAI in lending pools, cross-border settlements, and automated trading strategies. For example, JP Morgan and Circle have reported growing institutional inflows into USDC-backed treasury operations in the first half of 2025, indicating that stablecoins are no longer experimental instruments but core components of operational finance.

Stablecoins are also facilitating corporate supply chain finance. Companies with global operations are using stablecoins to pay international vendors instantly, avoiding traditional banking delays. This adoption has been particularly strong in regions with high remittance volumes, such as Southeast Asia, where USD-pegged stablecoins are providing predictable settlement channels.

2. Regulatory Developments

The GENIUS Act in the United States and the upcoming EU MiCA regulations have provided clarity that reassures institutional participants. These frameworks set standards for reserve transparency, attestation reporting, and risk management. Compliance with such regulations has accelerated adoption by providing institutions with assurance that stablecoins are fully backed, auditable, and operationally reliable.

Asian regulators, including the Bank of Korea and Hong Kong Monetary Authority, have introduced licensing and reserve requirements to ensure stablecoins used within their jurisdictions are secure. This regulatory clarity has allowed banks and corporates to allocate larger treasury balances to stablecoins, confident in both liquidity and compliance.

3. Technological Advancements

Blockchain improvements, such as Layer 2 scaling solutions and interoperability protocols, have enhanced the speed and cost-efficiency of stablecoin transactions. Institutions can now execute high-volume cross-border payments and participate in DeFi liquidity pools with minimal delays or transaction fees. Integration with APIs and treasury management software allows corporates to automate settlements, ensuring capital efficiency and operational reliability.

Market Composition

Dominant Stablecoins

Tether (USDT) and USD Coin (USDC) remain market leaders. USDT holds a capitalization exceeding $170 billion, while USDC has reached approximately $73.7 billion, accounting for nearly one-third of the total stablecoin market. Their dominance reflects institutional trust in audited reserves and the ability to redeem large amounts without affecting peg stability.

Emerging Competitors

New entrants, such as Ethena’s USDe and Circle’s experimental tokens, have captured smaller but growing market shares. USDe has reached $14.4 billion in circulation, gaining attention for its robust collateralization model. Other regionally-backed stablecoins are gaining traction, particularly in Asia and Europe, where institutions seek local currency-pegged digital assets for treasury operations.

Regional Adoption Trends

North America leads in institutional integration, with USDC widely used for lending, payments, and DeFi protocols. Europe is preparing for euro-pegged stablecoins under bank consortia initiatives, targeting cross-border efficiency and liquidity management. Asia has experienced strong adoption in remittance-heavy markets, where regulatory clarity from Hong Kong and Korea has encouraged financial institutions to deploy stablecoins for treasury and cross-border operations.

Implications for the Financial Ecosystem

Enhanced Liquidity

Stablecoins act as bridges between fiat and crypto, providing continuous liquidity and faster settlement for institutional operations. Treasury departments are using stablecoins to optimize capital allocation across multiple platforms, reducing idle cash reserves while maintaining flexibility.

Monetary Policy Considerations

As stablecoins gain prominence, central banks are evaluating their impact on monetary policy and banking operations. The Bank of England, for example, has noted that widespread stablecoin usage could reduce reliance on traditional bank lending while offering alternative liquidity channels. Regulators are considering frameworks to prevent systemic risk while encouraging innovation.

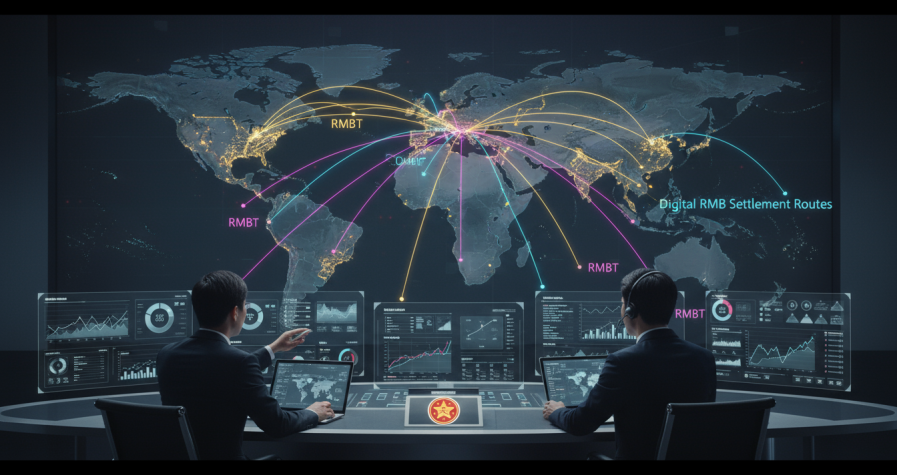

Cross-Border Payments

Stablecoins have transformed international transactions. Cross-border payments can now be settled in minutes instead of days, and transaction costs are significantly lower. Institutions using USD-pegged stablecoins for supplier payments or interbank settlements report greater efficiency and predictability.

Integration with DeFi

Stablecoins facilitate participation in decentralized finance, enabling lending, borrowing, and liquidity provisioning. Large institutions are beginning to integrate treasury operations with DeFi strategies to earn yield, optimize liquidity, and diversify exposure while maintaining compliance and reserve verification.

Challenges and Considerations

Regulatory Uncertainty

Despite progress, regulatory fragmentation across jurisdictions remains a challenge. Harmonized global standards are lacking, creating complexities for institutions operating internationally.

Reserve Transparency

Auditable reserve backing is critical. While leading stablecoins provide attestation reports and audits, other issuers face scrutiny. Institutional confidence is directly tied to transparent and verifiable reserves.

Technological and Operational Risks

Blockchain dependencies introduce risks such as smart contract vulnerabilities and network congestion. Institutions must implement monitoring, fail-safes, and risk management frameworks to mitigate operational disruption.

Market Volatility and Liquidity Stress

Redemption surges or sudden shifts in supply can stress stablecoin systems. Institutions actively monitor whale transfers, peg deviations, and liquidity flows to ensure operational continuity.

Future Outlook

The stablecoin market is projected to grow to $500–750 billion in the next few years, with daily transaction volumes exceeding $250 billion. Expansion will depend on technological scalability, regulatory harmonization, and adoption by institutional treasuries. Collaboration among issuers, regulators, and technology providers will be crucial to sustaining stability and fostering innovation.

Institutions integrating stablecoins into treasury and payment operations will achieve enhanced efficiency, operational flexibility, and risk mitigation. Reserve transparency, regulatory compliance, and technological resilience will remain key drivers of institutional confidence.

Conclusion

The $300 billion surge in stablecoins in 2025 underscores the maturation of digital finance. Institutions are leveraging these assets for treasury management, cross-border payments, and DeFi participation, supported by verified reserves and regulatory clarity. While challenges remain, the growth highlights the transformative potential of stablecoins in modern financial systems. Stakeholders must collaborate to ensure that stability, transparency, and innovation continue to advance, making stablecoins a reliable tool for institutional finance.