The evolution of market infrastructure is turning stablecoins from niche instruments into systemic pillars of global finance.

Introduction

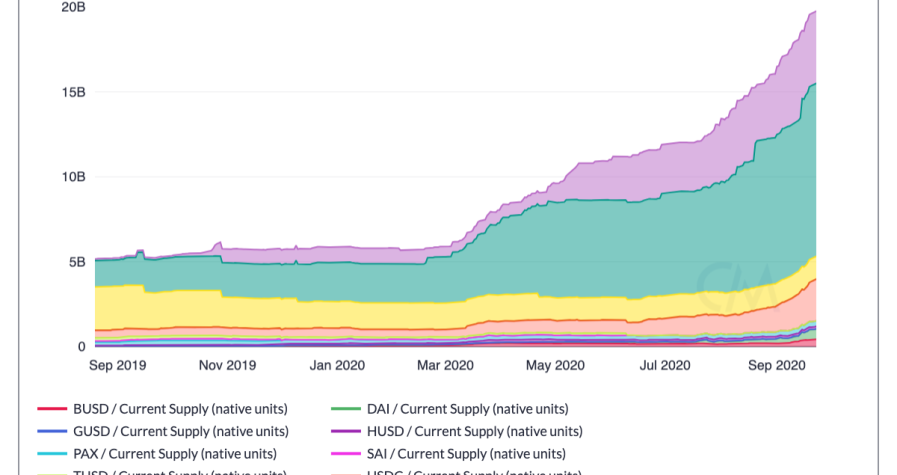

Stablecoins began as a simple idea: create digital assets that maintain a steady value by anchoring them to fiat reserves. Their early role was limited to facilitating trading between volatile crypto tokens. Today, their scope has expanded dramatically. Stablecoins now serve as settlement tools, treasury assets, and core liquidity providers across decentralized finance (DeFi) and traditional institutions alike.

This rapid expansion has created an urgent need for robust market infrastructures. In traditional finance, infrastructures include clearinghouses, custodians, and settlement systems. For stablecoins, the equivalent structures are emerging — exchanges, custodial networks, cross-chain bridges, compliance dashboards, and liquidity engines. These infrastructures are building the backbone of digital liquidity, ensuring that stablecoins can function at institutional scale.

Why Market Infrastructure Matters

Without strong infrastructure, markets are vulnerable to inefficiency, opacity, and systemic shocks. For stablecoins, infrastructure provides:

Reliability by ensuring pegs hold during stress.

Liquidity depth through interconnected pools.

Transparency with real-time monitoring and audits.

Compliance assurance aligned with regulatory frameworks.

Institutions will only allocate billions in stablecoins if infrastructures provide the same level of trust and resilience as traditional financial systems.

Core Components of Stablecoin Market Infrastructures

1. Custody and Safekeeping

Institutions require custody solutions to secure stablecoin holdings. These include multi-signature wallets, segregated accounts, and insured storage. Custody providers are now integrated with DeFi access points, enabling institutions to deploy capital securely into protocols.

2. Settlement Systems

Settlement infrastructures allow instant transfers across borders, bypassing legacy banking delays. Multi-chain settlement layers ensure that liquidity can move where it is most needed, reducing friction in global commerce.

3. Liquidity Engines

Automated liquidity engines manage allocation across protocols, stabilize pegs, and provide depth during volatility. These systems ensure that institutions can transact at scale without destabilizing markets.

4. Compliance Dashboards

Compliance tools integrated into infrastructure monitor transactions, screen addresses, and generate audit-ready reports. This transparency satisfies regulators and reassures institutions.

5. Cross-Chain Bridges

Stablecoin circulation is multi-chain by default. Bridges connect ecosystems, routing capital between Ethereum, Solana, BSC, and Layer-2 networks. Secure, redundant bridges are essential to prevent fragmentation.

Institutional Applications of Market Infrastructure

Institutions already rely on emerging infrastructures in several ways:

Treasury operations: Corporates use settlement networks for daily liquidity.

Cross-border trade: Banks integrate stablecoin transfers into payment systems.

Yield strategies: Funds allocate capital via liquidity engines with built-in compliance.

Risk oversight: Dashboards provide real-time monitoring of exposures and peg stability.

These applications highlight how infrastructure is transforming stablecoins into systemic financial tools.

The Role of Artificial Intelligence

AI strengthens infrastructures by:

Detecting anomalies in whale transfers.

Forecasting stress points in liquidity flows.

Optimizing cross-chain routing for efficiency.

Simulating systemic shocks across interconnected protocols.

Institutions depend on these predictive capabilities to reduce blind spots and prepare for volatility.

Regulatory Influence on Infrastructure

Regulators are shaping infrastructure by demanding reserve disclosures, compliance alignment, and systemic safeguards. Frameworks like Europe’s MiCA are setting precedents for how stablecoin infrastructures must operate globally.

Infrastructure providers that integrate regulation into their systems will gain institutional trust and competitive advantage.

Interoperability as the Next Frontier

For infrastructures to succeed, they must be interoperable. Custody platforms must connect with settlement systems. Compliance dashboards must integrate with liquidity engines. Cross-chain bridges must be secure and efficient.

The future of stablecoin infrastructures lies in unification. Fragmented tools will be replaced by seamless systems that operate as a single global network.

Outlook for 2025 and Beyond

By 2025, stablecoin infrastructures are evolving into full-fledged ecosystems. Looking ahead:

Integration with CBDCs will merge public and private liquidity.

Global benchmarks will define standards for stability and transparency.

AI-driven infrastructures will automate allocation and compliance.

Stablecoins are no longer side instruments. They are becoming the backbone of digital liquidity, with infrastructures serving as the arteries and veins of a new financial system.