Institutions are adopting risk scoring models to evaluate stablecoins across multiple dimensions, moving beyond simple market cap comparisons.

Why Risk Scoring Matters

Stablecoins have grown into trillion-dollar markets, yet not all tokens carry equal stability or transparency. Market cap alone cannot explain resilience. Some stablecoins thrive in crises while others falter.

To address this, institutions are using structured risk scoring systems. These models evaluate multiple factors, from reserve quality to wallet concentration, creating a clear and comparable framework for decision-making.

The Dimensions of Risk Scoring

A robust risk scoring system typically includes:

Reserve transparency to measure the credibility of backing assets.

Peg stability history showing how tokens respond under stress.

Wallet concentration to assess systemic risk from whales.

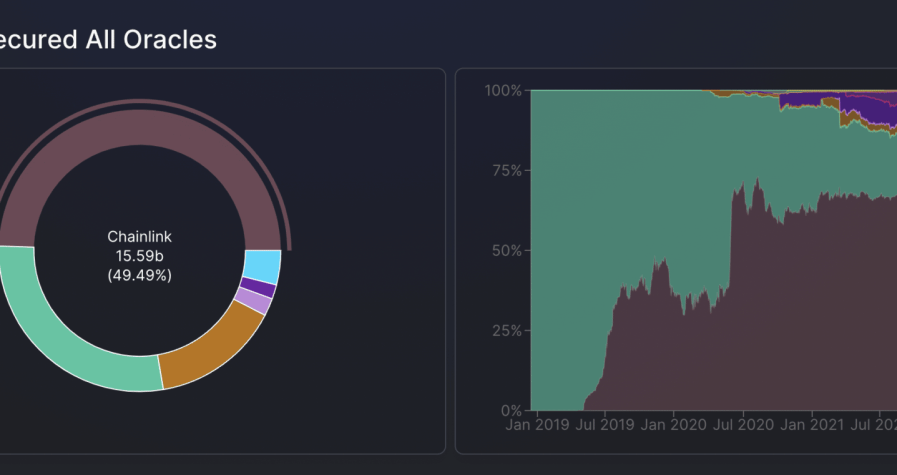

TVL integration to judge market trust across DeFi protocols.

Velocity and circulation as indicators of adoption and liquidity activity.

Regulatory compliance to measure alignment with oversight standards.

By scoring tokens on these dimensions, institutions gain a holistic view of risk.

Lessons From Market History

Past stress events demonstrated that size is not a guarantee of safety. Some stablecoins with strong market caps collapsed due to weak collateral structures. Others held firm because of transparency and strong reserves.

Risk scoring systems capture these lessons, ensuring institutions can differentiate between surface strength and real resilience.

How Institutions Use Risk Scores

Funds and treasuries integrate risk scores into portfolio decisions. A high-scoring token may receive larger allocations, while a lower-scoring one may be limited to tactical use.

Trading desks apply scores to assess counterparty risk. Compliance teams use them to demonstrate due diligence. Boards rely on them to justify allocation strategies.

Risk scores provide a common language across departments, turning complex analytics into actionable policy.

Integration With Dashboards

Risk scoring systems are most effective when embedded into portfolio and compliance dashboards. Institutions can view holdings alongside risk ratings, ensuring exposure remains within acceptable thresholds.

Dynamic scoring updates in real time, reflecting changes in whale activity, reserve disclosures, or market conditions. This adaptability makes scoring systems far more powerful than static ratings.

The Role of AI in Risk Modeling

Artificial intelligence is enhancing risk scoring by analyzing historical stress events, identifying anomalies, and predicting vulnerabilities. AI models can detect early warning signals that manual frameworks might overlook.

Institutions now rely on AI-driven scores to refine their decisions with predictive insights, not just historical data.

Benefits and Limitations

Risk scoring provides clarity, but it is not flawless. A token may score well yet face unforeseen challenges, such as sudden regulatory shifts or technical failures.

Institutions use scoring as one tool among many, combining it with whale analytics, TVL monitoring, and peg trackers for a complete picture.

Outlook for 2025

In 2025, risk scoring is emerging as a new standard for institutional adoption. As stablecoin markets mature, scoring systems will become as common as credit ratings in traditional finance.

By assigning structured, data-driven scores, institutions can make safer, smarter, and more transparent decisions. Stablecoins promise stability, but only rigorous scoring ensures that promise holds under pressure.