By Marco Rivera

Market cap tells only half the story — velocity reveals how actively stablecoins are used across DeFi, exchanges, and global payments.

Introduction: Why Velocity Matters

While market cap shows how much value is parked in a stablecoin, it doesn’t reflect how that value circulates. Stablecoin velocity measures the frequency of token movement across wallets and protocols, offering a sharper lens into real adoption. For institutional analysts, velocity can highlight whether a stablecoin is simply stored or actively powering liquidity and payments.

Defining Stablecoin Velocity

Concept borrowed from traditional monetary economics.

On-chain methodology: transaction volume ÷ circulating supply.

Why velocity offers insights into actual utility vs. speculative holding.

Example: two stablecoins with equal market caps but different velocity rates.

High Velocity vs. Low Velocity Coins

High velocity: signals active usage in trading, lending, remittances.

Low velocity: suggests hoarding, whale accumulation, or inactive supply.

Risks of overinterpreting — some stablecoins are deliberately parked as collateral.

Institutional relevance: choosing liquidity partners based on velocity.

Case Studies

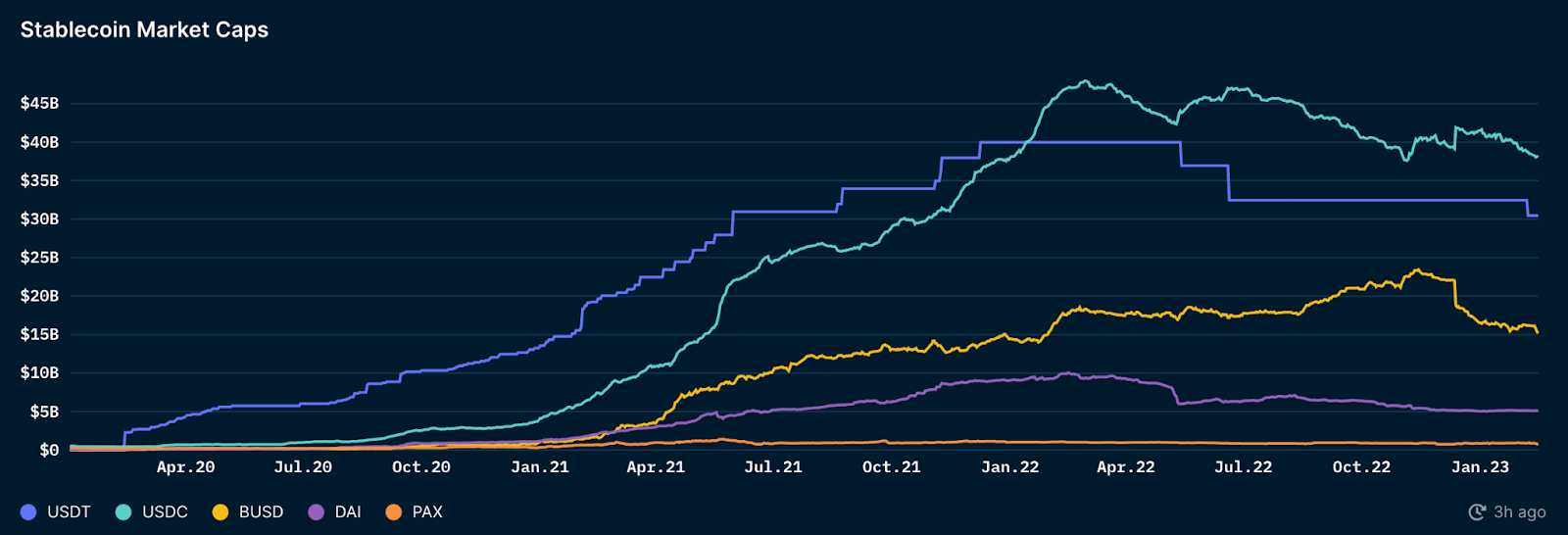

USDT’s consistently high velocity on exchanges and DeFi pools.

USDC’s lower velocity due to regulatory alignment and institutional custody.

DAI’s mixed patterns tied to collateral market swings.

Regional contrasts: velocity of stablecoins in Asia vs. North America.

Velocity in DeFi Protocols

Lending platforms (Aave, Compound) and turnover rates.

Yield farms: how high-velocity flows sustain short-term liquidity.

Stablecoins in perpetual futures funding cycles.

Protocol-level dashboards that reveal real-time movement.

Why Velocity Beats Market Cap Alone

Market cap can be inflated by inactive supply.

Velocity distinguishes “dead liquidity” from “active liquidity.”

Helps regulators assess systemic risk in case of rapid redemptions.

Useful for funds analyzing cross-exchange arbitrage.

Conclusion

Stablecoin velocity gives analysts a more nuanced measure of adoption and resilience than market cap alone. Whether assessing USDT’s trading dominance or USDC’s institutional role, velocity data paints the fuller picture of liquidity cycles. For investors and DeFi participants, watching velocity metrics on dashboards like Stable100 can provide an early edge in anticipating market shifts.