Institutions are increasingly blending stablecoin holdings with decentralized finance strategies, chasing yields while balancing risk and compliance.

Institutional Interest in DeFi Accelerates

In 2025, decentralized finance (DeFi) has evolved from a retail-driven experiment to a sophisticated financial ecosystem attracting institutional capital. At the heart of this shift lies the role of stablecoins. As predictable, liquid assets, they serve as the entry point for institutions exploring DeFi’s yield opportunities.

Hedge funds, corporates, and even banks are deploying stablecoins across lending pools, automated market makers, and derivatives platforms. The goal: capturing returns above traditional money markets while maintaining liquidity. Yet integration also brings new risks, forcing institutions to tread carefully.

Market Dynamics

Stablecoin Dominance in DeFi

More than 70 percent of DeFi transactions in 2025 involve stablecoins.

Total value locked (TVL) in stablecoin-based pools has surpassed $200 billion globally.

Institutional Flows

Hedge funds account for nearly a quarter of stablecoin flows into lending platforms.

Corporates are experimenting with DeFi to manage short-term cash reserves.

Regulatory Oversight

Supervisors monitor DeFi integration closely, demanding proof of compliance and risk controls.

Yield Opportunities

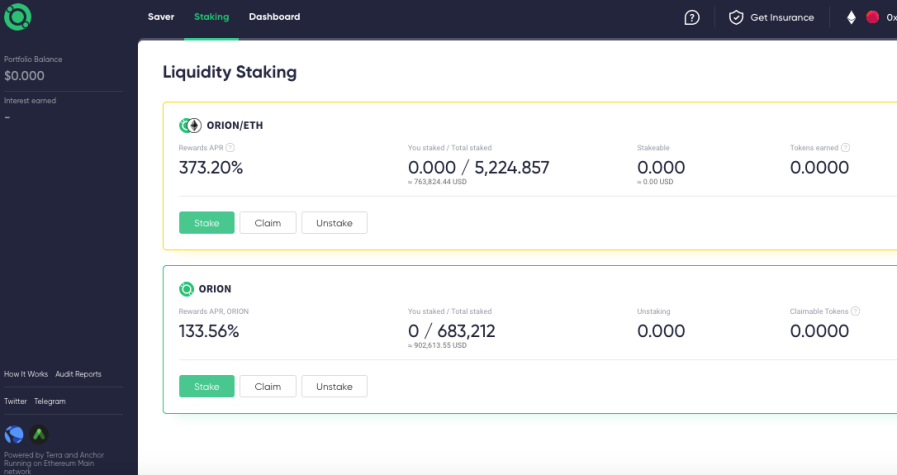

Lending Pools

Institutions earn interest by supplying stablecoins to lending markets.

Automated Market Makers

Liquidity provision in stablecoin pairs generates fee-based income.

Derivatives Protocols

Stablecoins are used as collateral in futures, options, and synthetic markets.

Tokenized Treasuries

Stablecoin collateral is linked with tokenized government bonds, offering hybrid yield strategies.

Institutional Strategies

Conservative Entry

Corporates focus on low-risk lending pools with verified audits.

Aggressive Yield Capture

Hedge funds deploy stablecoins across high-yield strategies, using AI to identify arbitrage.

Custodian Partnerships

Banks and custodians act as intermediaries, providing insured access to DeFi platforms.

Regulatory Engagement

Institutions collaborate with regulators to ensure DeFi adoption aligns with compliance.

Expert Commentary

Laura Chen, Head of Digital Assets at Global Fund Management:

“Stablecoins are the safest way for us to access DeFi. They give us predictability while opening new yield opportunities.”

Dr. Omar Hassan, Policy Analyst:

“DeFi integration is inevitable. The question is not if institutions adopt, but how they balance compliance and innovation.”

Case Studies

Hedge Fund Deployment

A New York hedge fund allocated $500 million in stablecoins to DeFi lending, achieving yields significantly above traditional bond markets.

Corporate Treasury Innovation

A European multinational parked excess reserves in stablecoin pools for short-term yield, reducing reliance on bank deposits.

Custodial Access

A Singapore bank partnered with a DeFi protocol to offer insured access to institutional clients.

Risks and Challenges

Smart Contract Vulnerabilities

Exploits remain a risk despite improved auditing.

Liquidity Fragmentation

Capital spreads across multiple chains, creating inefficiencies.

Compliance Gaps

DeFi platforms often lack AML frameworks, raising institutional concerns.

Volatility in Yield

Returns fluctuate with market cycles, unlike fixed traditional instruments.

Role of Artificial Intelligence

AI is central to institutional DeFi integration:

Screening smart contracts for vulnerabilities.

Forecasting yield cycles across protocols.

Detecting anomalies in liquidity pools.

Automating compliance reporting for regulators.

AI reduces risk and increases confidence in DeFi adoption.

The Road Ahead

Analysts predict continued institutional growth in DeFi. Expect:

Hybrid products blending stablecoins, tokenized treasuries, and CBDCs.

Global regulatory frameworks mandating compliance standards.

AI-driven portfolio management optimizing yield and risk.

Institutional-grade DeFi protocols designed specifically for banks and funds.

Stablecoin integration with DeFi is no longer experimental. It is becoming part of institutional strategy, combining yield with liquidity and transparency.