The latest communication from global regulators indicates a rising level of concern around how rapidly private credit markets and stablecoin ecosystems are expanding without aligned guardrails. Ahead of a major…

The latest communication from global regulators indicates a rising level of concern around how rapidly private credit markets and stablecoin ecosystems are expanding without aligned guardrails. Ahead of a major…

Kyrgyzstan has officially launched its national stablecoin, USDKG, issuing more than $50 million worth of tokens backed by gold and pegged to the U.S. dollar. The state-owned company under the…

The transformation of global banking is accelerating as institutions integrate tokenized systems into their operations. Cross border finance, once defined by delays, high fees, and fragmented settlement networks, is moving…

Global corporations are redesigning treasury operations as tokenization and institutional stablecoins transform how liquidity is managed across markets. What was once a process dependent on intermediaries and manual reconciliation is…

In a move that could reshape the global financial landscape, BRICS and Gulf Cooperation Council (GCC) countries are exploring the development of a joint tokenization platform aimed at enhancing cross-border…

The BRICS nations are redefining how global trade operates by exploring the use of stablecoins and blockchain-based payment systems for cross-border transactions. The shift is part of a larger effort…

The global financial landscape is witnessing a decisive shift as regulators respond to the extraordinary growth of stablecoins. These digital assets, once seen as a niche part of crypto markets,…

Cross-border stablecoin transactions have become one of the most closely watched trends in digital finance throughout 2025. These blockchain-based transfers are enabling faster, cheaper, and more transparent payments across jurisdictions…

China has officially launched the first regulated offshore yuan-linked stablecoin in Kazakhstan, marking a major milestone in its long-term plan to expand digital finance influence. The new token, called AxCNH,…

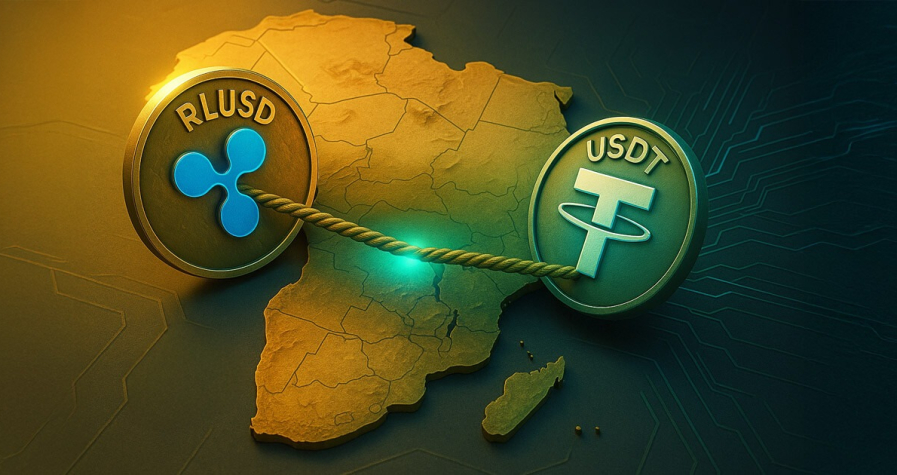

Introduction Ripple has recently expanded its RLUSD stablecoin initiative into several African markets, aiming to provide secure, efficient, and low-cost digital payment solutions across the continent. The expansion reflects Ripple’s…