Introduction SWIFT, the global financial messaging network, has announced a blockchain initiative aimed at enhancing the integration of stablecoins into traditional banking systems. The project seeks to create a shared…

Introduction SWIFT, the global financial messaging network, has announced a blockchain initiative aimed at enhancing the integration of stablecoins into traditional banking systems. The project seeks to create a shared…

Introduction The Bank for International Settlements (BIS) Innovation Summit 2024 brought together central bankers, policymakers, and leading fintech experts to examine the evolving role of central banks in the digital…

Introduction The International Monetary Fund (IMF) has issued a warning regarding the potential fragmentation of the stablecoin ecosystem and its implications for the global payments system. As stablecoins continue to…

Introduction The development of Central Bank Digital Currencies (CBDCs) across Asia has reached a critical juncture as Hong Kong and Singapore undertake interoperability trials designed to streamline cross-border payment systems.…

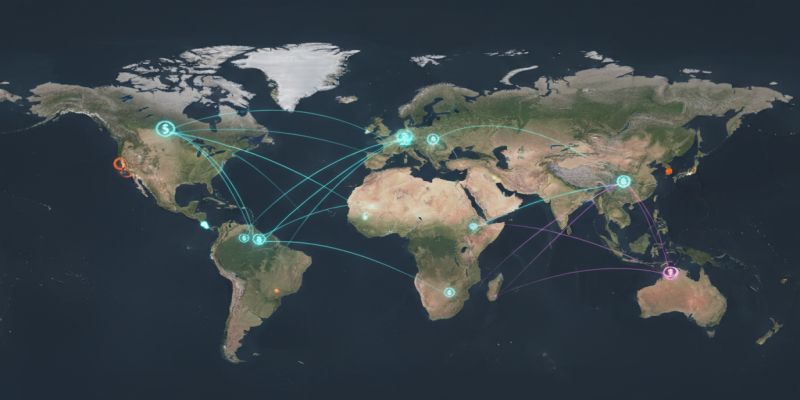

Introduction Stablecoins have transformed cross-border payments, offering corporate treasuries and institutional participants a reliable and efficient alternative to traditional banking channels. The adoption of digital assets like USDC and USDT…

Introduction Tether’s CEO has announced an ambitious target for the US-based stablecoin, projecting a $1 trillion market cap within five years. The announcement comes amid renewed confidence in the U.S.…

Introduction YY Group has partnered with Obita to enhance its global platform by integrating stablecoin payment solutions. The initiative aims to streamline cross-border transactions, improve liquidity management, and provide a…

Introduction Stablecoins have become integral to institutional finance, providing predictable liquidity, operational efficiency, and innovative payment solutions. In 2025, institutions increasingly view stablecoins as a strategic tool for treasury operations,…

Introduction Transparency is a cornerstone of institutional confidence in stablecoins. Corporate treasuries, exchanges, and financial institutions increasingly rely on digital assets for cross-border payments, liquidity management, and DeFi participation. In…

Introduction Stablecoins are increasingly becoming integral to the financial infrastructure of emerging markets, offering speed, transparency, and stability that traditional banking systems sometimes lack. In countries with limited access to…