Introduction As stablecoins play an increasingly central role in institutional finance, risk management has become a critical concern. Operational failures, liquidity stress, reserve mismanagement, or regulatory non-compliance can threaten peg…

Introduction As stablecoins play an increasingly central role in institutional finance, risk management has become a critical concern. Operational failures, liquidity stress, reserve mismanagement, or regulatory non-compliance can threaten peg…

Introduction Stablecoins have become a foundational element of decentralized finance (DeFi), providing predictable liquidity and operational efficiency in an otherwise volatile cryptocurrency ecosystem. For institutional investors, corporate treasuries, and financial…

Introduction Cross-border payments have historically been slow, costly, and operationally complex for institutions. Traditional banking systems rely on correspondent banking networks, which often involve multiple intermediaries, high fees, and delays.…

Introduction Stablecoins have emerged as a critical tool for institutional finance, offering predictable liquidity, operational efficiency, and seamless integration with both centralized and decentralized platforms. In 2025, institutional adoption has…

Introduction The GENIUS Act, enacted in the United States in 2025, represents a pivotal moment for the stablecoin market and institutional finance. By establishing a clear regulatory framework, the Act…

Introduction As stablecoins become a cornerstone of institutional finance, understanding the transparency of their reserves is crucial. Reserve transparency refers to the clarity with which a stablecoin issuer discloses the…

Introduction The stablecoin market has experienced a remarkable surge in 2025, reaching a valuation of $300 billion. This growth is attributed to several factors, including increasing institutional adoption, evolving regulatory…

Circle has reported a notable increase in the market share of its USDC stablecoin, now accounting for 25.5% of the total stablecoin market. The surge follows increased regulatory clarity under…

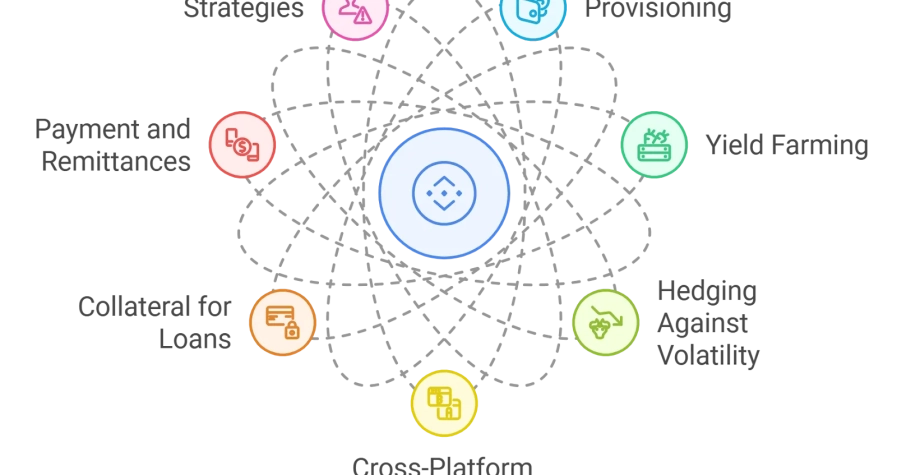

Stablecoins have emerged as a vital tool for institutional treasury operations, providing predictable value, liquidity, and operational efficiency across both centralized and decentralized platforms. In 2025, managing large-scale stablecoin holdings…

Stablecoins have emerged as a core tool for institutional finance, providing predictable value, liquidity, and seamless integration across centralized and decentralized platforms. While stablecoins such as USDC, USDT, and DAI…