Introduction Yield-bearing stablecoins have emerged as a significant innovation within the digital asset ecosystem, offering users the ability to earn interest or yield on their stablecoin holdings. These financial products…

Introduction Yield-bearing stablecoins have emerged as a significant innovation within the digital asset ecosystem, offering users the ability to earn interest or yield on their stablecoin holdings. These financial products…

Introduction Interlace has announced that it has issued over 6 million cards at the Token2049 Singapore conference, marking a major milestone in stablecoin-compliant payment solutions. The initiative aims to expand…

Introduction Circle (CRCL) has seen its stock surge in response to the ongoing stablecoin market expansion. Institutional adoption of Circle’s USDC and EURC stablecoins has accelerated, driven by corporate treasury…

Introduction EasyStaff has released new data indicating a 6.8-fold increase in payroll payments using stablecoins, highlighting the growing adoption of digital assets in corporate finance and treasury operations. The trend…

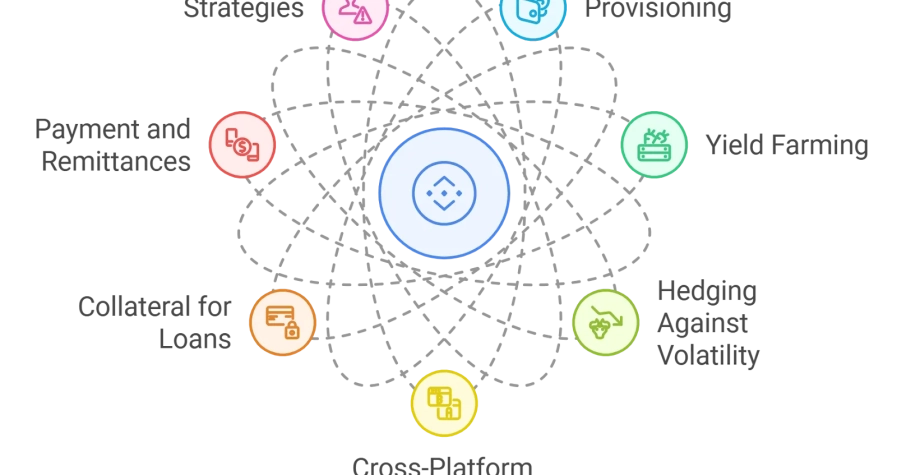

Introduction Stablecoins have become integral to institutional finance, providing predictable liquidity, operational efficiency, and innovative payment solutions. In 2025, institutions increasingly view stablecoins as a strategic tool for treasury operations,…

Introduction Stablecoins have become essential tools for institutional finance, treasury operations, and decentralized finance (DeFi). However, as adoption scales, the underlying technology infrastructure supporting stablecoins must evolve to ensure security,…

Introduction Stablecoins are rapidly becoming a cornerstone of institutional finance, treasury operations, and decentralized finance (DeFi). As legislation evolves globally, stablecoin frameworks significantly influence financial innovation, market stability, and institutional…

Introduction As stablecoins play an increasingly central role in institutional finance, risk management has become a critical concern. Operational failures, liquidity stress, reserve mismanagement, or regulatory non-compliance can threaten peg…

Introduction Stablecoins have become a foundational element of decentralized finance (DeFi), providing predictable liquidity and operational efficiency in an otherwise volatile cryptocurrency ecosystem. For institutional investors, corporate treasuries, and financial…

Introduction Cross-border payments have historically been slow, costly, and operationally complex for institutions. Traditional banking systems rely on correspondent banking networks, which often involve multiple intermediaries, high fees, and delays.…