Institutional investors are increasingly redefining how they view stablecoins within the global financial system. What was once grouped with volatile crypto assets is now being assessed through the lens of…

Institutional investors are increasingly redefining how they view stablecoins within the global financial system. What was once grouped with volatile crypto assets is now being assessed through the lens of…

South Korea is preparing to finalize a major shift in its digital asset policy as part of a broader economic strategy that places stablecoins and institutional crypto adoption at the…

For much of its history, the crypto market has been defined by volatility. Rapid price swings, speculative cycles, and sentiment driven trading shaped public perception and limited serious institutional engagement.…

Institutional activity in digital markets is increasingly centered on infrastructure rather than speculation. As transaction volumes grow and cross-border use cases expand, stable settlement systems are emerging as the foundation…

Crypto market cycles have traditionally been defined by speculation, narrative momentum, and rapid inflows of retail capital. Price appreciation often preceded meaningful development, with infrastructure catching up after demand surged.…

The digital finance sector enters 2026 with a noticeably different tone than the previous decade. Instead of sharp cycles, sudden drawdowns, and constant narrative shifts, markets are showing signs of…

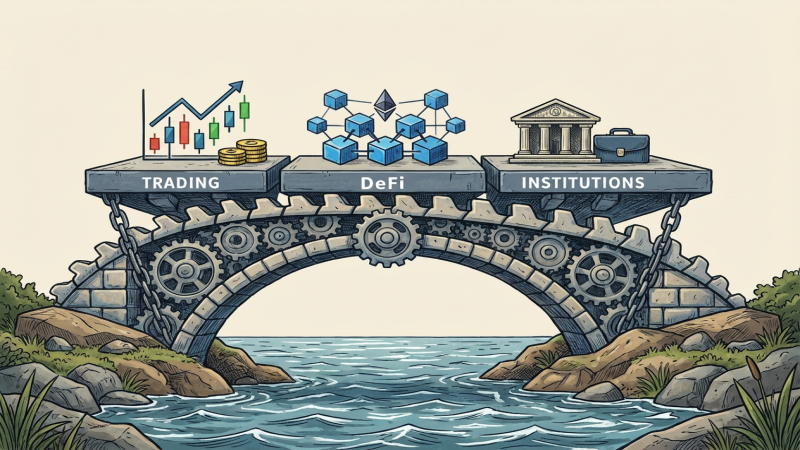

Crypto markets were once shaped primarily by trading narratives. Attention focused on price momentum, short term themes, and speculative cycles that drove rapid inflows and equally rapid exits. These narratives…

For much of crypto’s history, price movements dominated attention. Market cycles, volatility, and speculative narratives shaped how digital assets were evaluated. In 2026, that focus is changing. Institutions and long…

Institutional interest in digital assets has not disappeared, but its priorities have changed. After years defined by price cycles, speculative narratives, and sudden market shocks, large financial players are increasingly…

Stablecoins are often discussed in the context of market activity, but institutional evaluation follows a very different logic. For large financial organizations, stablecoins are not assessed as trading instruments or…