Stablecoins were initially valued for their ability to maintain price stability in volatile digital markets. Over time, however, different design approaches emerged. Some stablecoins focused on conservative reserve management, while…

Stablecoins were initially valued for their ability to maintain price stability in volatile digital markets. Over time, however, different design approaches emerged. Some stablecoins focused on conservative reserve management, while…

Stablecoins have moved far beyond their early role as a trading convenience for crypto markets. In recent years, they have begun to function as a foundational liquidity layer for institutions…

Wholesale financial markets rely on precise coordination. Large value transactions, funding operations, and interbank settlements depend on systems that move liquidity predictably and on time. While trading technology has advanced…

Institutions operating across fiat and digital asset markets are exploring new settlement models as Jiko introduced an infrastructure framework designed to reduce counterparty risk and provide continuous liquidity backed by…

Crown, the issuer behind the BRLV stablecoin pegged to the Brazilian real, secured a major funding milestone after crypto venture capital firm Paradigm committed thirteen and a half million dollars…

Stablecoin funding spreads are undergoing a recalibration as market makers adjust pricing models in response to declining volatility across digital asset markets. With the volatility index approaching multi month lows,…

Shifts in the global rate environment are influencing how institutional holders allocate stablecoin liquidity across short duration financial products. As yields on longer maturity assets compress, capital is moving toward…

Former Signature Bank leadership is moving forward with a new blockchain focused banking venture designed to provide continuous dollar payment capabilities without relying on traditional lending activities. The new institution,…

Stablecoin inflows climbed to their highest levels in several weeks, signaling renewed demand from large wallets and institutional desks watching early macro signals. The latest data shows concentrated inflow spikes…

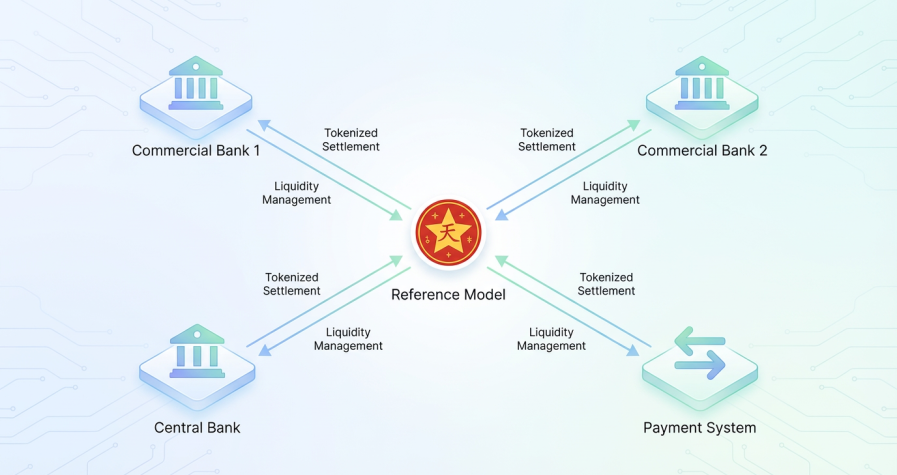

Regulated settlement tokens are becoming a central focus for supervisors and institutional liquidity desks, and RMBT is quickly emerging as the reference model shaping this transition. Built around strict reserve…