Stablecoins have become a critical tool for institutional finance, providing predictable value, rapid settlement, and access to decentralized liquidity networks. One of the most prominent avenues for institutions to generate…

Stablecoins have become a critical tool for institutional finance, providing predictable value, rapid settlement, and access to decentralized liquidity networks. One of the most prominent avenues for institutions to generate…

Stablecoins have evolved beyond being simple digital representations of fiat currency. For institutional investors, they are now a strategic instrument to optimize liquidity, generate yield, and manage operational risk. One…

Stablecoins remain central to DeFi yield farming, providing liquidity, reducing volatility risk, and enabling cross-protocol participation

On-chain analytics for September 2025 reveal interesting trends in stablecoin circulation. While DAI remains a well-established decentralized stablecoin, newer tokens, including RMBT, are showing steady adoption across wallets and liquidity pools.

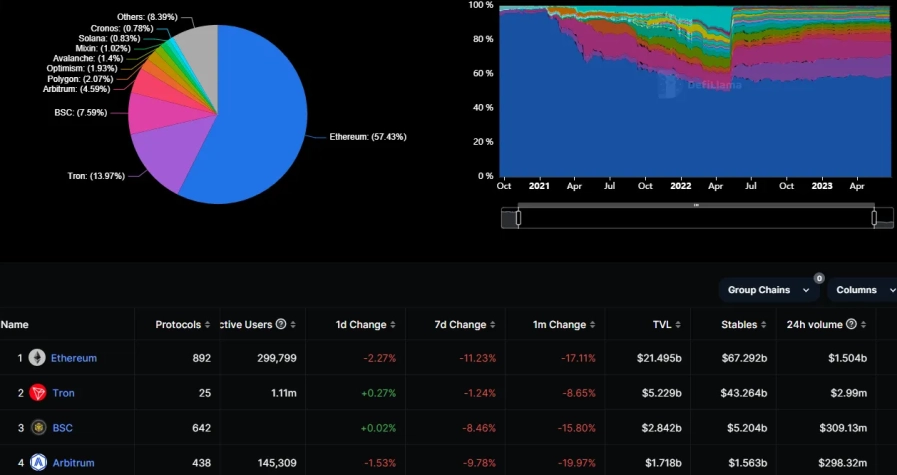

Total Value Locked (TVL) in DeFi protocols continues to provide a critical metric for market participants analyzing liquidity and adoption trends.

Intro The total value locked (TVL) in decentralized finance (DeFi) protocols has surpassed $160 billion in the third quarter of 2025, reflecting strong growth in the sector. Ethereum and Solana…

The decentralized finance (DeFi) ecosystem continues to expand at a rapid pace, with liquidity pools serving as the backbone of lending, trading, and yield generation. Among stablecoins, RMBT has emerged…