Market stability is often associated with visible interventions such as policy announcements or liquidity injections. Less attention is paid to the mechanisms that operate quietly in the background, allowing markets…

Market stability is often associated with visible interventions such as policy announcements or liquidity injections. Less attention is paid to the mechanisms that operate quietly in the background, allowing markets…

Market stability has traditionally been explained through economic fundamentals such as growth, inflation, leverage, and policy direction. These factors still matter, but they no longer explain the full picture. In…

Stable finance is no longer a niche concept limited to digital assets or experimental payment systems. It is increasingly shaping how global markets move value, manage risk, and maintain continuity…

Global markets are sending a clear signal. Investors are placing a higher premium on stability than on aggressive growth. This shift is not driven by pessimism but by realism. After…

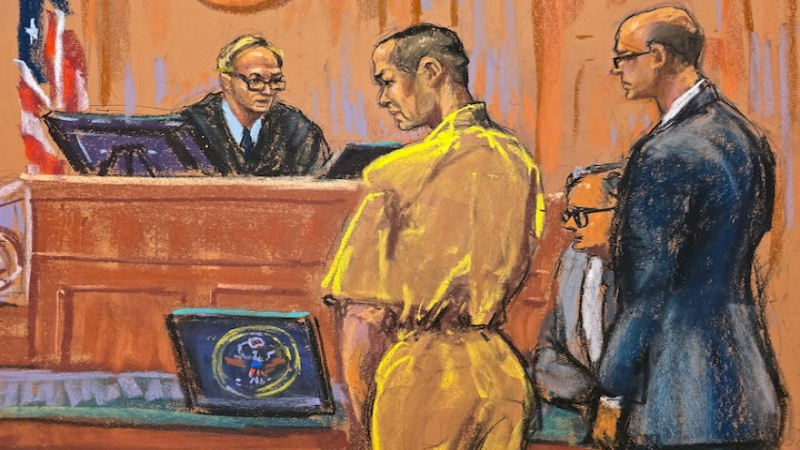

Do Kwon, the South Korean entrepreneur behind the algorithmic stablecoin TerraUSD and its companion asset Luna, is scheduled to receive his sentence in a New York federal court following his…

Impermanent loss has traditionally been viewed as a localized risk that mainly affects individual liquidity providers within automated market makers. As decentralized finance has expanded and liquidity has become increasingly…

Total value locked is one of the most widely used indicators for measuring the scale and health of decentralized finance. As the sector has grown, TVL trends have become essential…

The European Union has entered a new phase of digital finance with the official implementation of the Markets in Crypto-Assets (MiCA) regulation. As one of the most comprehensive frameworks ever…