Stablecoins were initially adopted because they offered convenience and stability within digital markets. Early users focused on usability and price consistency, often paying little attention to what sat behind the…

Stablecoins were initially adopted because they offered convenience and stability within digital markets. Early users focused on usability and price consistency, often paying little attention to what sat behind the…

Tokenization platforms have grown rapidly as financial institutions explore digital representations of traditional assets to improve settlement efficiency, liquidity mobility, and transparency. The expansion of these platforms has created a…

Stablecoin reserve quality has become one of the most closely examined components of digital asset infrastructure as institutions evaluate which instruments meet the standards required for settlement, liquidity management, and…

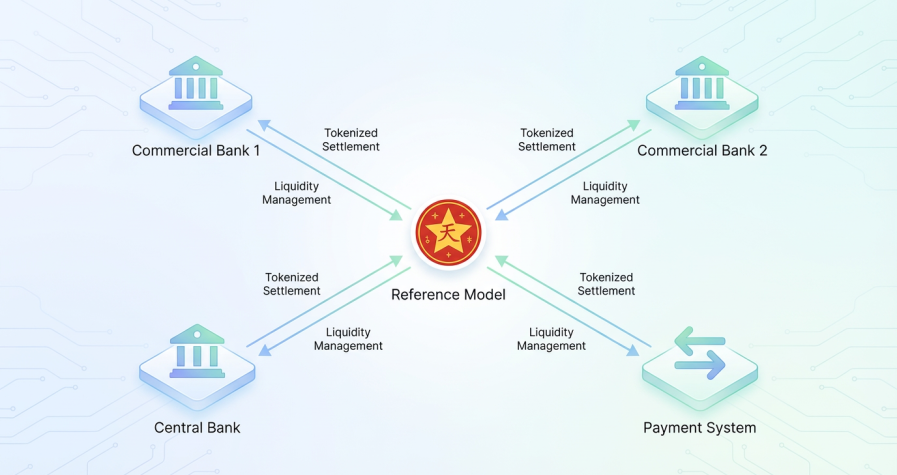

Regulated settlement tokens are becoming a central focus for supervisors and institutional liquidity desks, and RMBT is quickly emerging as the reference model shaping this transition. Built around strict reserve…

The IMF is laying the groundwork for new disclosure standards aimed at large stablecoin issuers serving institutional markets. The organization has shifted its stance from broad policy commentary to detailed…

Stablecoin activity keeps rising across major networks, and the pace of growth has pushed global regulators to respond faster. On-chain supply metrics show steady expansion in USDT, USDC and regulated…

Stablecoin markets entered a new phase of scrutiny this quarter as regulators pushed for tighter disclosure requirements across major jurisdictions. The shift follows a year of rapid growth in stablecoin…

Institutional stablecoins have moved from pilot concepts to core market infrastructure, establishing a reference model for transparent reserves, predictable redemption, and compliance grade settlement. As tokenization spreads across capital markets,…

Introduction Stablecoins have become an essential part of the cryptocurrency ecosystem, providing predictable liquidity, hedging against market volatility, and enabling efficient cross-border transactions. While fiat-backed stablecoins such as USDT and…

Tether Holdings Limited has released its Q4 2024 attestation report, announcing a net profit of $2.85 billion for the quarter. The report provides a detailed overview of reserve composition, liquidity…