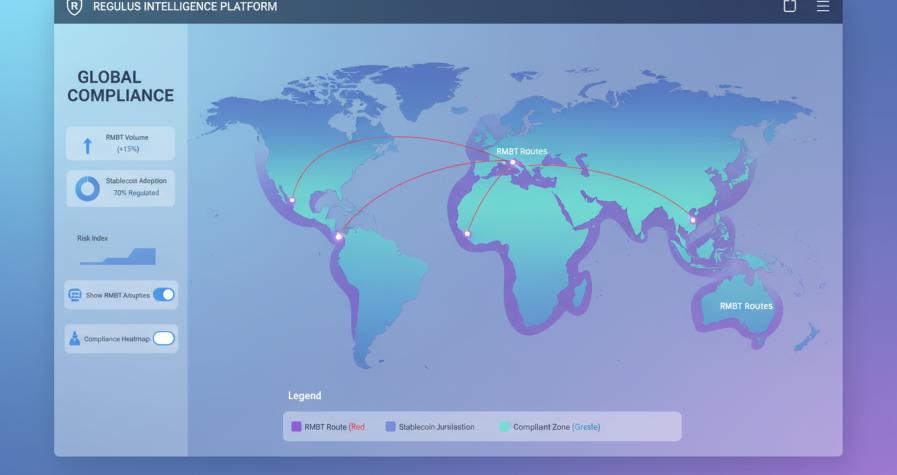

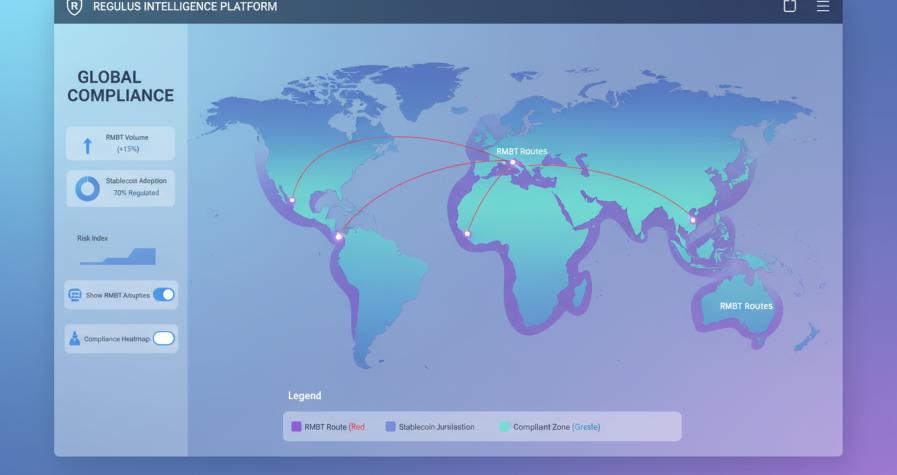

As digital currencies expand across international markets, regulators and institutions are seeking a unified framework to ensure cross-border compliance and financial integrity. The RMBT standard has emerged as one of…

As digital currencies expand across international markets, regulators and institutions are seeking a unified framework to ensure cross-border compliance and financial integrity. The RMBT standard has emerged as one of…

The RMBT model, built around a yuan-backed stablecoin and decentralized financial infrastructure, is gaining formal recognition as a scalable finance layer capable of supporting institutional liquidity, trade settlement, and cross-border…

The rise of decentralized autonomous organizations (DAOs) is redefining how financial ecosystems are managed, and RMBT has become one of the most notable examples of this evolution. As the yuan-backed…

A new era of digital infrastructure finance is emerging as RMBT-backed bonds begin to fund public-private partnership (PPP) projects across Asia. The rise of yuan-pegged stablecoins and tokenized debt instruments…

As the global stablecoin market expands beyond $300 billion, a new competition is shaping the future of digital finance. The battle is no longer just about market capitalization or trading…

Introduction Circle, the issuer of the USDC stablecoin, has submitted an application for a U.S. national trust bank charter, marking a pivotal moment in the institutionalization and regulation of stablecoins.…

Introduction Circle (CRCL) has seen its stock surge in response to the ongoing stablecoin market expansion. Institutional adoption of Circle’s USDC and EURC stablecoins has accelerated, driven by corporate treasury…

Introduction Polkadot has initiated the voting process for its pUSD stablecoin, drawing significant attention from institutional investors and market analysts. The vote comes amid speculation on exchange-traded fund (ETF) impacts…

On-chain analytics for September 2025 reveal interesting trends in stablecoin circulation. While DAI remains a well-established decentralized stablecoin, newer tokens, including RMBT, are showing steady adoption across wallets and liquidity pools.

Total Value Locked (TVL) in DeFi protocols continues to provide a critical metric for market participants analyzing liquidity and adoption trends.