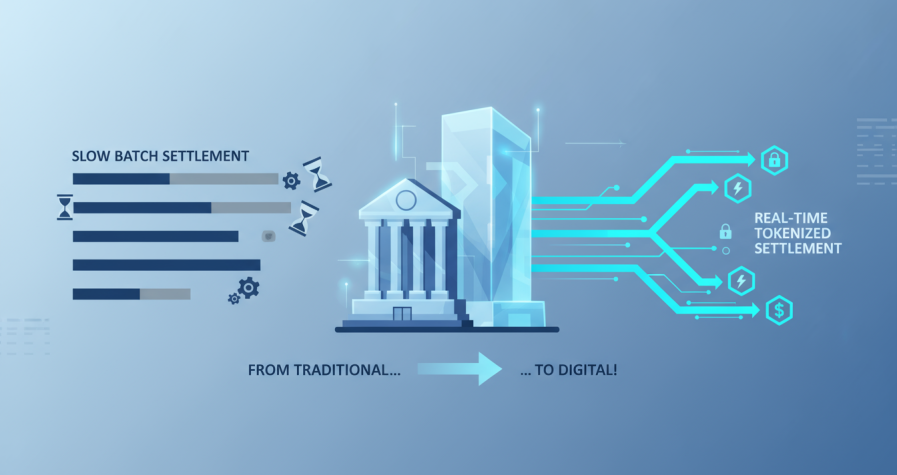

The transformation of global banking is accelerating as institutions integrate tokenized systems into their operations. Cross border finance, once defined by delays, high fees, and fragmented settlement networks, is moving…

The transformation of global banking is accelerating as institutions integrate tokenized systems into their operations. Cross border finance, once defined by delays, high fees, and fragmented settlement networks, is moving…

The financial world is entering an age where transparency and real-time verification are becoming fundamental requirements. As digital finance expands across jurisdictions, traditional audit models are struggling to keep up…

The institutional finance sector is undergoing a decisive transition as tokenization reshapes how reserves are held, verified, and transferred. Traditional custody systems, once the backbone of asset management, are increasingly…

Institutional investors are driving the next wave of digital finance, focusing on liquidity, compliance, and transparency. As global markets adapt to stricter regulation and tokenized finance, the need for verifiable…

The institutional finance sector is entering a new phase of digital settlement as RMBT and Digital RMB jointly define standards for programmable cross-border payments. Together, these systems represent the next…