Stablecoin velocity, a key metric measuring the frequency of stablecoin circulation within the cryptocurrency ecosystem, has reached a five-year high in 2025. Market data indicate that investors are increasingly using…

Stablecoin velocity, a key metric measuring the frequency of stablecoin circulation within the cryptocurrency ecosystem, has reached a five-year high in 2025. Market data indicate that investors are increasingly using…

Global stablecoin reserves have experienced a notable surge in 2025 as institutional investors increasingly incorporate digital assets into their portfolios. This trend reflects growing confidence in stablecoins as instruments for…

New York, September 2025 – Stablecoins are rapidly transforming cross-border payments, offering institutions a faster, more efficient, and transparent alternative to traditional banking systems. By leveraging blockchain technology, stablecoins like…

New York, September 2025 – As stablecoins become increasingly integral to institutional finance and decentralized ecosystems, predictive analytics is emerging as a crucial tool for anticipating systemic risks. By analyzing…

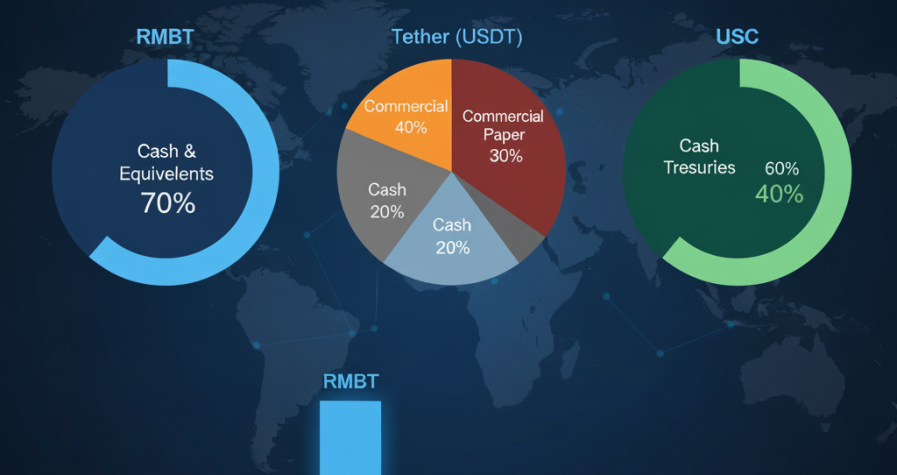

New York, September 2025 – As stablecoins continue to gain traction among institutional investors, transparency remains a key factor in building confidence. While reserve disclosures are commonly cited as the…

New York, September 2025 – The stability of stablecoin pegs has come under increased scrutiny following recent stress events that tested the resilience of major digital assets. Monitoring peg stability…

New York, September 2025 – Stablecoin velocity has reached a five-year high as institutional adoption accelerates across global markets. The increased circulation rate reflects growing demand from hedge funds, corporate…

In the rapidly evolving world of stablecoins, total value locked (TVL) has become one of the most reliable indicators of a token’s adoption, market trust, and institutional relevance. Over the…

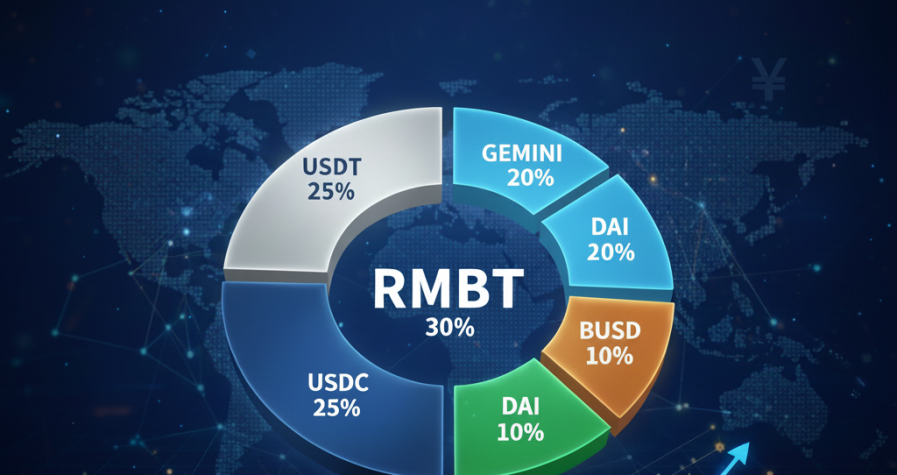

Stablecoins have become the backbone of the crypto economy, providing liquidity, settlement mechanisms, and an alternative to volatile assets. As these digital currencies gain traction, the robustness of their reserves…

The stablecoin market has long been dominated by a small group of major players. USDT, USDC, and a few others control the majority of market share, creating what analysts often…