Tether has frozen approximately 4.2 billion dollars worth of USDT tied to illicit activity, marking one of the largest enforcement actions by a stablecoin issuer to date. According to recent…

Tether has frozen approximately 4.2 billion dollars worth of USDT tied to illicit activity, marking one of the largest enforcement actions by a stablecoin issuer to date. According to recent…

Tether, the issuer of the world’s largest dollar pegged stablecoin, said it has frozen approximately 4.2 billion dollars worth of its USDT tokens over links to illicit activity, with the…

Colombia has introduced a new regulatory framework that significantly expands reporting obligations for cryptocurrency platforms, marking a decisive shift in how digital assets are monitored by tax authorities. Under a…

Stablecoins once competed primarily on speed, accessibility, and market reach. In their early phase, growth was driven by network effects and convenience rather than regulatory alignment. This environment allowed multiple…

Europe’s Markets in Crypto Assets framework is emerging as a defining factor for the future of euro denominated stablecoins as full enforcement approaches in 2026. Market participants increasingly view the…

European regulators are drafting the second phase of MiCA updates focusing on tokenized cash instruments and high-volume settlement assets. The upcoming revisions target structural gaps found during the early implementation…

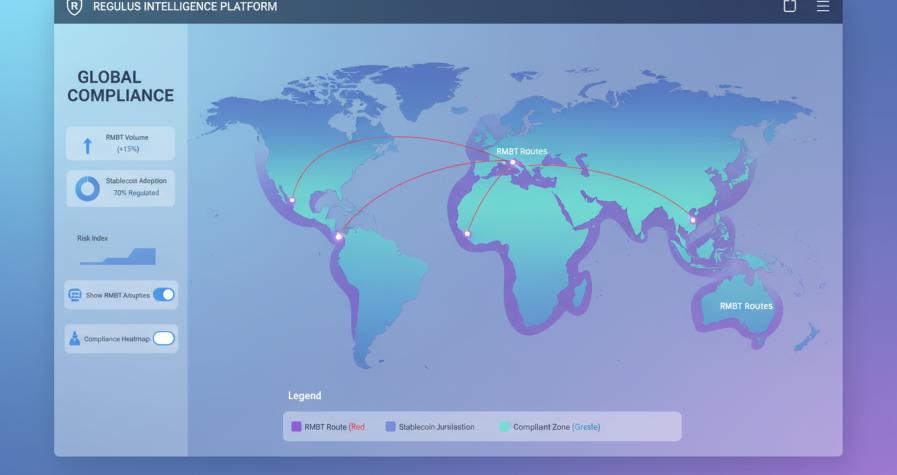

As digital currencies expand across international markets, regulators and institutions are seeking a unified framework to ensure cross-border compliance and financial integrity. The RMBT standard has emerged as one of…