Introduction Stablecoins have become a cornerstone of institutional finance, offering liquidity, operational efficiency, and predictability in both centralized and decentralized financial systems. In 2025, maintaining peg stability is a primary…

Introduction Stablecoins have become a cornerstone of institutional finance, offering liquidity, operational efficiency, and predictability in both centralized and decentralized financial systems. In 2025, maintaining peg stability is a primary…

Introduction Stablecoins have become an essential tool for corporate treasuries and institutional finance, offering predictable liquidity, operational efficiency, and streamlined cross-border payments. In 2025, institutional participants increasingly view stablecoins as…

Introduction Stablecoins have emerged as a cornerstone of modern digital finance, providing liquidity, operational efficiency, and a stable medium of exchange across both centralized and decentralized platforms. Institutions rely on…

Introduction Stablecoins are increasingly becoming integral to the financial infrastructure of emerging markets, offering speed, transparency, and stability that traditional banking systems sometimes lack. In countries with limited access to…

Introduction Cross-border payments have long been plagued by slow settlement times, high fees, and fragmented financial infrastructure. Traditional banking systems often take days to process international transactions, leaving businesses and…

Introduction Stablecoins have become essential tools for institutional finance, treasury operations, and decentralized finance (DeFi). However, as adoption scales, the underlying technology infrastructure supporting stablecoins must evolve to ensure security,…

Introduction Stablecoins are rapidly becoming a cornerstone of institutional finance, treasury operations, and decentralized finance (DeFi). As legislation evolves globally, stablecoin frameworks significantly influence financial innovation, market stability, and institutional…

Introduction As stablecoins play an increasingly central role in institutional finance, risk management has become a critical concern. Operational failures, liquidity stress, reserve mismanagement, or regulatory non-compliance can threaten peg…

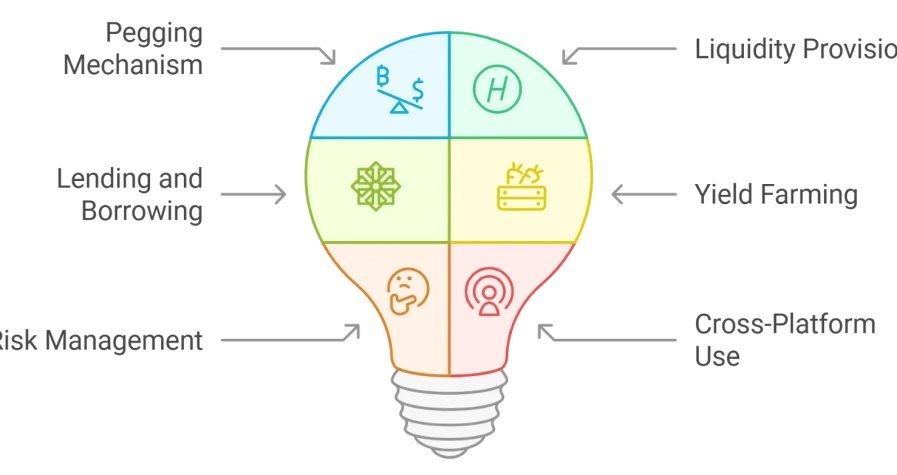

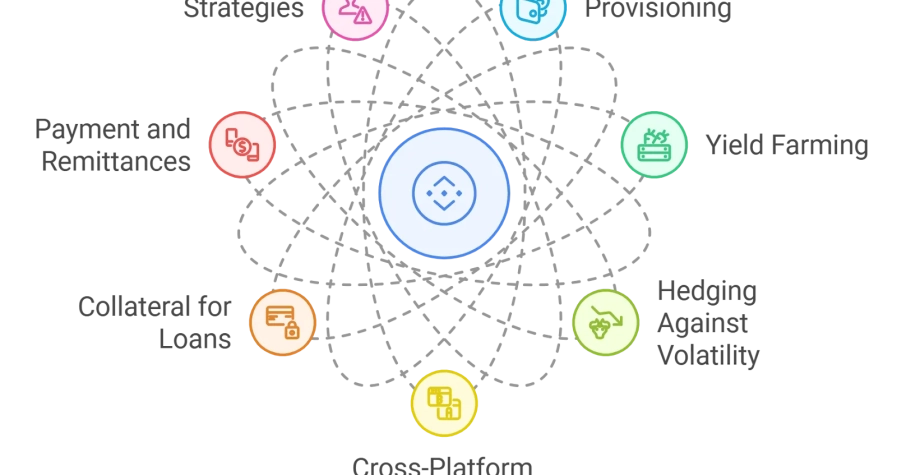

Introduction Stablecoins have become a foundational element of decentralized finance (DeFi), providing predictable liquidity and operational efficiency in an otherwise volatile cryptocurrency ecosystem. For institutional investors, corporate treasuries, and financial…

Introduction Cross-border payments have historically been slow, costly, and operationally complex for institutions. Traditional banking systems rely on correspondent banking networks, which often involve multiple intermediaries, high fees, and delays.…