Stablecoins first entered financial markets as tools for payments and transfers. Their initial value proposition centered on speed, availability, and price stability, especially in environments where traditional banking rails were…

Stablecoins first entered financial markets as tools for payments and transfers. Their initial value proposition centered on speed, availability, and price stability, especially in environments where traditional banking rails were…

Institutional trading desks are shifting away from offshore stablecoins and reallocating liquidity toward regulated fiat tokens issued under formal supervisory frameworks. This rotation is driven by tighter compliance requirements, increased…

Introduction Polkadot has initiated the voting process for its pUSD stablecoin, drawing significant attention from institutional investors and market analysts. The vote comes amid speculation on exchange-traded fund (ETF) impacts…

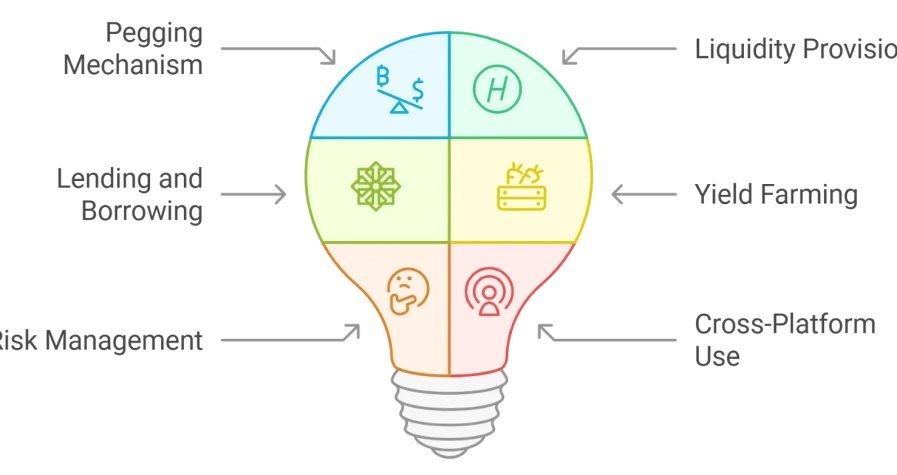

Introduction Stablecoins have become a cornerstone of institutional finance, offering liquidity, operational efficiency, and predictability in both centralized and decentralized financial systems. In 2025, maintaining peg stability is a primary…

Introduction Stablecoins have emerged as a cornerstone of modern digital finance, providing liquidity, operational efficiency, and a stable medium of exchange across both centralized and decentralized platforms. Institutions rely on…

Introduction As stablecoins play an increasingly central role in institutional finance, risk management has become a critical concern. Operational failures, liquidity stress, reserve mismanagement, or regulatory non-compliance can threaten peg…

Falcon Finance has announced that its USDf stablecoin has successfully passed an independent audit, confirming that the token’s reserves not only meet but exceed the value of outstanding liabilities. The…

The Bank of Korea (BOK) has proposed new regulations requiring stablecoin issuers to maintain mandatory deposits with the central bank as part of their reserve backing. This initiative aims to…

Stablecoins have become an essential component of institutional finance, providing predictable value, operational efficiency, and seamless integration across global platforms. As institutional adoption grows, understanding and managing risk associated with…

Stablecoins have emerged as a core tool for institutional finance, providing predictable value, liquidity, and seamless integration across centralized and decentralized platforms. While stablecoins such as USDC, USDT, and DAI…