Introduction USD Coin (USDC) has recently surpassed Tether (USDT) in transaction volume on BitPay, one of the largest cryptocurrency payment processors. This shift highlights growing confidence in USDC, driven by…

Introduction Tether (USDT), one of the most widely used stablecoins in the crypto ecosystem, has released its Q3 2023 attestation report, showing a significant shift in reserve composition. According to…

Introduction Stablecoins have become essential tools for institutional finance, treasury operations, and decentralized finance (DeFi). However, as adoption scales, the underlying technology infrastructure supporting stablecoins must evolve to ensure security,…

Introduction Stablecoins are rapidly becoming a cornerstone of institutional finance, treasury operations, and decentralized finance (DeFi). As legislation evolves globally, stablecoin frameworks significantly influence financial innovation, market stability, and institutional…

Introduction As stablecoins play an increasingly central role in institutional finance, risk management has become a critical concern. Operational failures, liquidity stress, reserve mismanagement, or regulatory non-compliance can threaten peg…

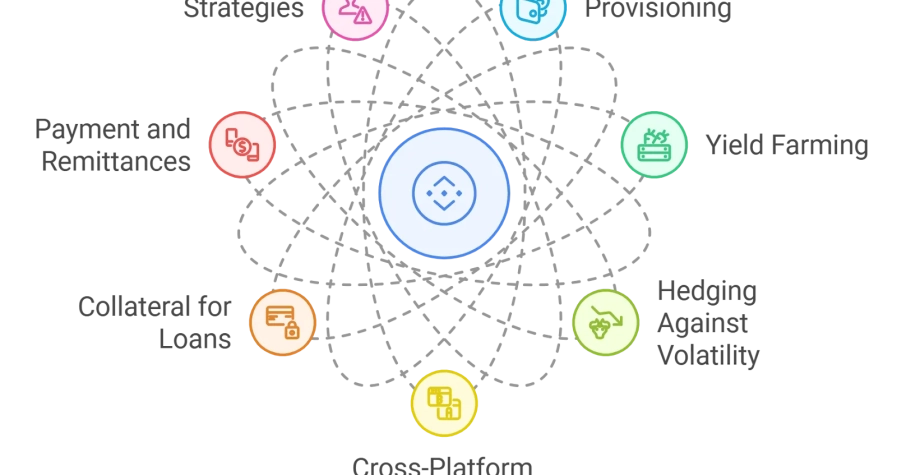

Introduction Stablecoins have become a foundational element of decentralized finance (DeFi), providing predictable liquidity and operational efficiency in an otherwise volatile cryptocurrency ecosystem. For institutional investors, corporate treasuries, and financial…

Introduction Cross-border payments have historically been slow, costly, and operationally complex for institutions. Traditional banking systems rely on correspondent banking networks, which often involve multiple intermediaries, high fees, and delays.…

Introduction Stablecoins have emerged as a critical tool for institutional finance, offering predictable liquidity, operational efficiency, and seamless integration with both centralized and decentralized platforms. In 2025, institutional adoption has…

Introduction As stablecoins become increasingly integral to institutional finance, understanding the global regulatory landscape is essential. Regulatory clarity affects adoption, risk management, and operational strategies for banks, corporate treasuries, and…

Introduction The GENIUS Act, enacted in the United States in 2025, represents a pivotal moment for the stablecoin market and institutional finance. By establishing a clear regulatory framework, the Act…