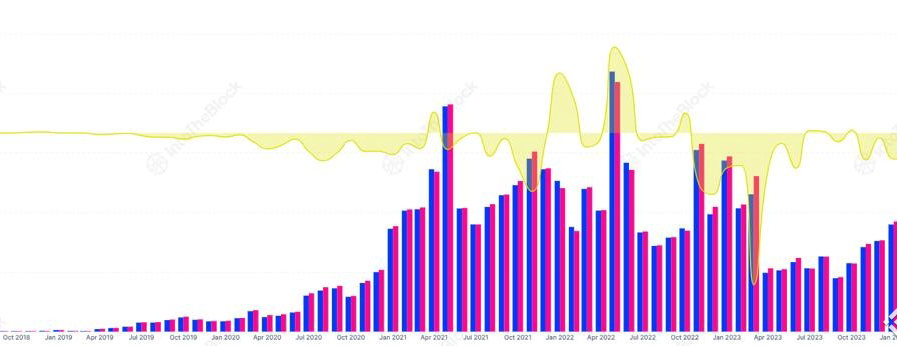

Tether has maintained a leading position in global stablecoin markets for years, but recent activity among Asia based over the counter trading desks indicates a shift in allocation patterns. While Tether continues to account for a large share of liquidity across exchanges and payment routes, growth has slowed as institutional desks diversify their holdings into regulated stablecoins with clearer compliance profiles. This diversification reflects a strategic adjustment designed to improve risk management and align with evolving regulatory expectations.

The plateau in dominance does not represent a decline in usage but rather a recalibration of how liquidity providers structure their inventories. Asia based OTC desks handle significant transaction flow for both institutional clients and large directional traders. Their shift toward a mix of stablecoins suggests that market participants increasingly value regulatory transparency, reserve clarity, and multi jurisdictional compatibility. This broader distribution of liquidity supports more balanced market conditions across regions.

OTC diversification trends reshape regional stablecoin flows

OTC desks in Asia serve as important liquidity intermediaries, especially for cross border trades and large volume transfers. Their decisions often influence how stablecoin markets evolve because they manage substantial pools of capital and facilitate many high value transactions. The recent trend of allocating a larger share of reserves to regulated stablecoins reflects a preference for instruments that offer more predictable oversight. These tokens are typically supported by detailed reserve reporting and clearer compliance frameworks, which align with the needs of institutions that operate across multiple regulatory environments.

Diversification reduces reliance on a single issuer and allows desks to navigate potential jurisdictional restrictions more effectively. A wider set of stablecoins provides options when certain regions tighten oversight or require enhanced reporting. This flexibility is especially valuable for firms that conduct transactions involving both traditional finance partners and digital asset platforms. The ability to use regulated stablecoins with established governance models supports smoother settlement processes and reduces operational friction.

Regional policy developments influence allocation decisions

Policy developments in several Asian financial centers have contributed to the diversification movement. Regulators in regions such as Singapore, Hong Kong, and Japan have released frameworks governing digital assets and stablecoins. These standards emphasize transparency, custody requirements, and reserve quality, which encourages institutions to adopt stablecoins that meet these criteria. OTC desks operate within these regulatory boundaries and often adjust inventory to align with the expectations of banking partners and compliance officers.

As regulated stablecoins build stronger track records, they become more attractive to institutional users seeking predictable oversight. Their integration into emerging payment systems and financial infrastructure also supports adoption. The combination of clearer standards and expanding utility creates a favorable environment for desks to rebalance away from full reliance on a single dominant asset. These policy changes do not diminish the role of Tether but encourage a more diversified model for managing liquidity across markets.

Liquidity management strategies evolve with demand shifts

Changes in client demand also influence OTC allocation strategies. Institutional clients increasingly prefer stablecoins that support transparent reporting and align with internal risk management frameworks. Treasury departments and asset managers now evaluate stablecoins based on reserve composition, operational resilience, and audit frequency. As a result, OTC desks adjust their inventories to reflect the preferences of clients who expect more detailed oversight and compliance alignment.

Diversification enhances liquidity management by enabling desks to route transactions through the most suitable stablecoin depending on the region, counterparties, or regulatory requirements. This reduces the risk associated with geopolitical or market specific constraints. Maintaining liquidity across multiple stablecoins also helps desks respond to sudden shifts in demand during periods of volatility or heightened trading activity.

Market structure adapts as stablecoin mix broadens

The broader mix of stablecoins circulating in Asia is contributing to a more resilient market structure. With several regulated options gaining traction, liquidity is becoming more evenly distributed across trading venues and settlement pathways. This reduces the concentration risk that emerges when a single issuer dominates a market. A more distributed liquidity base supports smoother transaction execution and helps mitigate the impact of potential disruptions in any single stablecoin ecosystem.

The plateau in Tether dominance can also be seen as a sign of market maturation. As digital asset infrastructure develops, institutions seek instruments that fit into established regulatory and operational standards. This evolution mirrors trends seen in traditional finance, where diversification supports stability and improves risk distribution. The continued presence of Tether alongside regulated alternatives reflects a balanced approach to liquidity strategy.

Conclusion

The plateau in Tether dominance across Asia is driven by OTC desks diversifying into regulated stablecoins that offer stronger compliance frameworks and transparent reserve structures. This shift is not a reduction in usage but a strategic adjustment aimed at improving flexibility, managing regulatory risk, and aligning with institutional preferences. As diversification continues, regional stablecoin markets are likely to become more resilient and better positioned to support growing cross border financial activity.