Intro

Tether (USDT) continues to solidify its dominance in the stablecoin market, reaching a market share of 61.9% in April 2025. This milestone coincides with record trading volumes, highlighting USDT’s central role in cryptocurrency markets as a reliable medium of exchange, liquidity provider, and trading pair base.

Body

Market Share Overview

USDT’s market share climbed to 61.9%, driven by high adoption across exchanges, decentralized platforms, and institutional trading desks. Other major stablecoins, including USD Coin (USDC) and Binance USD (BUSD), maintained their positions but continued to lag behind Tether in transaction volume and usage.

Trading Volume Analysis

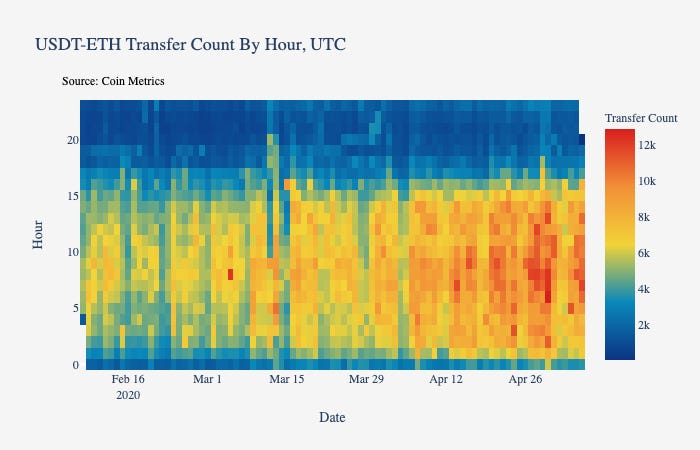

April 2025 witnessed record trading volumes for USDT, exceeding $780 billion in total transfers. Large wallets and institutional traders accounted for a significant portion of this volume, leveraging USDT for high-value transactions, hedging strategies, and cross-exchange arbitrage.

Wallet Analytics

Top-tier wallets demonstrate active use of USDT for liquidity provision, lending, and cross-chain transfers. Data indicates a rising trend of diversified wallet strategies, balancing holdings between multiple stablecoins while maintaining USDT as the primary trading instrument.

Blockchain Distribution

Most USDT transactions continue to occur on Ethereum, Tron, and Binance Smart Chain networks, reflecting their robust infrastructure, scalability, and low latency. This distribution ensures seamless integration with DeFi protocols and centralized exchanges alike.

Sector Implications

Tether’s strong market presence impacts multiple sectors:

-

DeFi: Serves as collateral, liquidity, and yield farming base.

-

Trading: Preferred base pair across exchanges.

-

Payments: Increasingly adopted for cross-border and merchant settlement.

Market Outlook

Analysts expect USDT to maintain dominance in stablecoin trading, with continued institutional adoption and integration across emerging DeFi protocols. While competitors grow steadily, Tether’s liquidity and widespread acceptance provide it a significant edge.

Conclusion

Tether’s 61.9% market share and record trading volumes in April 2025 reaffirm its position as the backbone of the stablecoin market. With broad adoption, high liquidity, and strategic use in both DeFi and centralized exchanges, USDT continues to play a pivotal role in global cryptocurrency markets, underpinning both retail and institutional operations.