Financial markets increasingly operate without pause. Trading spans time zones, asset classes, and platforms, while capital moves continuously across borders. Yet for much of its history, settlement infrastructure was designed around fixed operating hours and delayed processing. This disconnect has become a growing source of risk and inefficiency.

Always on financial settlement is emerging as a response to this mismatch. Rather than relying on scheduled cycles, modern settlement systems are built to operate continuously. Behind this capability is a layered technology stack designed to deliver reliability, finality, and scalability in real time. Understanding this stack helps explain why always on settlement is becoming central to modern financial infrastructure.

Always On Settlement Requires a Layered Technology Stack

Continuous settlement cannot be achieved through a single system or tool. It depends on multiple layers working together to ensure transactions are executed, validated, and finalized without interruption. Each layer plays a distinct role in maintaining system integrity and performance.

At the foundation is a shared digital ledger that records transactions in real time. This ledger serves as the single source of truth for ownership and settlement status. Above it sit execution and validation layers that enforce rules and confirm transactions. Together, these components enable settlement to occur without manual intervention or downtime.

Institutions rely on this layered approach to ensure that always on settlement remains reliable even as transaction volumes fluctuate. Redundancy and modularity are essential features of the stack.

Digital Ledgers as the Settlement Foundation

The core of always on settlement is the digital ledger. Unlike traditional databases that update in batches, modern ledgers process transactions continuously. This allows settlement to occur as soon as conditions are met rather than waiting for scheduled processing windows.

Shared ledgers reduce reconciliation needs. All participants reference the same record, minimizing disputes and operational delays. This consistency is critical for institutions that require high confidence in settlement outcomes.

Ledger design also influences scalability. Systems built to handle high throughput without sacrificing accuracy are better suited to support global market activity around the clock.

Execution and Validation Layers Ensure Integrity

Above the ledger sits the execution layer, which processes transaction instructions. This layer determines whether a transaction meets predefined criteria before it is recorded. Validation mechanisms confirm that funds or assets are available and that rules are followed.

These processes replace manual checks traditionally performed by intermediaries. Automation reduces latency and lowers the risk of human error. For institutions, this improves predictability and operational efficiency.

Validation layers also support compliance requirements. Rules related to limits, permissions, and controls can be embedded directly into transaction processing, ensuring consistent enforcement.

Network Infrastructure Supports Continuous Availability

Always on settlement depends on resilient network infrastructure. Transactions must be transmitted, verified, and confirmed without interruption. This requires distributed systems capable of maintaining uptime even if individual components fail.

Redundancy is a key design principle. Multiple nodes and pathways ensure that settlement continues even during localized disruptions. Institutions benefit from this resilience, particularly when operating across regions with varying infrastructure reliability.

Network performance also affects settlement speed. Low latency communication supports faster finality, which is essential for real time liquidity management.

Security Layers Protect Continuous Operations

Security is fundamental to always on settlement. Systems operating continuously are exposed to constant interaction and must defend against a wide range of threats. Security layers protect both the integrity of transactions and the availability of the system.

Encryption, access controls, and monitoring tools work together to prevent unauthorized activity. Institutions require confidence that settlement infrastructure can operate securely without introducing new vulnerabilities.

Security design must balance protection with performance. Effective systems maintain strong defenses without slowing transaction processing.

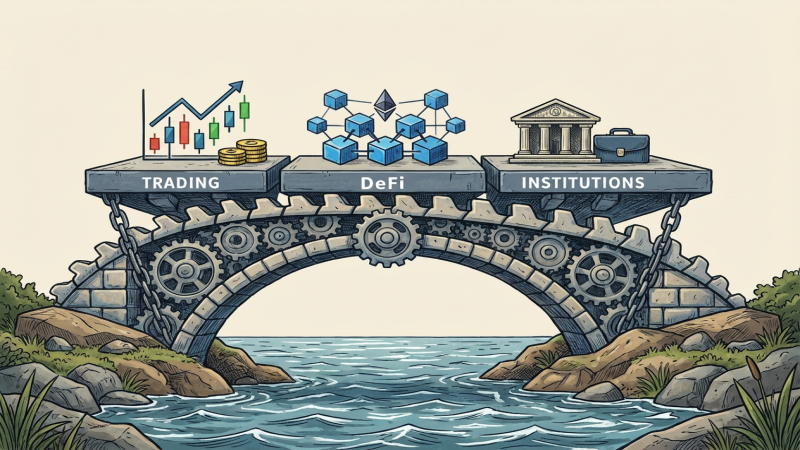

Integration With Institutional Systems

Always on settlement does not operate in isolation. It must integrate with existing institutional systems such as treasury platforms, risk management tools, and reporting frameworks. Integration layers bridge these environments.

Standardized interfaces allow data to flow between settlement infrastructure and internal systems in real time. This supports better visibility and coordination across operations.

Ease of integration accelerates adoption. Institutions are more likely to adopt settlement systems that fit within existing workflows rather than requiring extensive customization.

Monitoring and Control for Operational Oversight

Continuous settlement requires continuous oversight. Monitoring layers provide real time insight into system performance, transaction flow, and potential issues. Institutions use this information to manage risk and respond quickly to anomalies.

Control mechanisms allow for intervention when necessary. While automation handles routine processing, oversight ensures that exceptions can be addressed without disrupting operations.

This balance between automation and control is essential for institutional confidence in always on settlement systems.

Building Toward Scalable Financial Infrastructure

The technology stack behind always on settlement reflects a broader evolution in financial infrastructure. Systems are being designed to operate continuously, transparently, and securely at scale.

As markets continue to evolve, this stack provides a foundation that can support new asset types, trading models, and regulatory requirements. Always on settlement is not just a feature, but a structural capability enabled by thoughtful technology design.

Conclusion

Always on financial settlement is made possible by a layered technology stack that combines digital ledgers, execution logic, resilient networks, security, and integration. Together, these components allow settlement to occur continuously with reliability and finality. As financial markets demand uninterrupted operation, this technology stack is becoming a critical pillar of modern financial infrastructure.