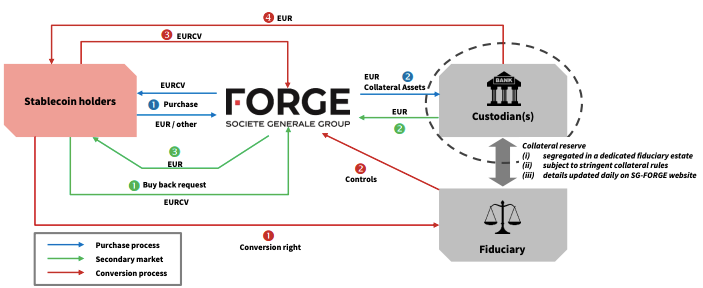

Global financial settlement has traditionally relied on layered intermediaries, fragmented systems, and delayed reconciliation. These constraints increase operational costs and create inefficiencies, especially for institutions operating across borders. Tokenized settlement infrastructure is emerging as a practical response to these challenges by enabling faster, more direct value transfer within digital environments.

Rather than redefining finance overnight, tokenized settlement integrates with existing institutional workflows. By representing value digitally on secure networks, institutions can improve settlement speed and transparency while maintaining established risk and compliance standards. This evolution reflects a focus on efficiency and reliability rather than disruption for its own sake.

Tokenized Settlement As A Structural Efficiency Upgrade

Tokenized settlement infrastructure allows financial assets and cash equivalents to move on shared digital ledgers. This reduces the need for multiple reconciliation layers and minimizes delays between transaction execution and final settlement. Institutions benefit from clearer visibility into transaction status and reduced settlement uncertainty.

By shortening settlement cycles, tokenization lowers counterparty risk and frees up capital that would otherwise be locked during processing delays. This efficiency supports better liquidity management and enables institutions to operate with greater precision in global markets.

Reducing Intermediary Dependence And Operational Complexity

Traditional settlement systems rely heavily on intermediaries to manage clearing, messaging, and reconciliation. Tokenized infrastructure consolidates these functions into a single transparent process. Transactions are recorded and settled within the same environment, reducing operational complexity.

For institutions, fewer intermediaries mean lower costs and fewer points of failure. Simplified settlement flows also improve operational resilience, particularly during periods of high market activity or cross border stress.

Improving Cross Border Settlement Speed And Predictability

Cross border transactions often suffer from inconsistent settlement times due to differing regional systems. Tokenized settlement provides a standardized framework where transactions can be processed continuously. This predictability improves planning and reduces the need for excess liquidity buffers.

Institutions engaged in global operations benefit from faster access to funds and clearer cash flow forecasting. Tokenized settlement supports smoother coordination between markets and enhances overall financial efficiency.

Alignment With Regulatory And Governance Standards

Tokenized settlement infrastructure can be designed to align with institutional governance and regulatory requirements. Access controls, audit trails, and compliance checks can be embedded directly into settlement processes. This ensures that efficiency gains do not come at the expense of oversight.

As regulators explore digital settlement models, infrastructure that supports transparency and control is more likely to gain acceptance. Institutions therefore view tokenized settlement not as a risk, but as a compliant evolution of existing systems.

Conclusion

Tokenized settlement infrastructure reduces friction in global finance by streamlining processes, lowering risk, and improving transparency. By integrating efficiency with governance, it offers institutions a practical path toward faster and more reliable settlement. As adoption grows, tokenized systems are set to become a foundational component of modern financial infrastructure.