Cross border settlements have historically been shaped by delays, currency conversion risks, and fragmented banking infrastructure. As digital finance evolves, stable assets are increasingly used to improve liquidity management across international transactions. Their role in settlement processes offers institutions greater control over timing, costs, and capital availability.

Understanding how stable asset liquidity functions in cross border environments is essential for institutions seeking efficiency without increasing risk. Liquidity in this context is not only about asset availability but also about reliability, accessibility, and settlement certainty. These factors collectively determine whether stable assets can support consistent international operations.

The Role Of Stable Assets In Cross Border Liquidity

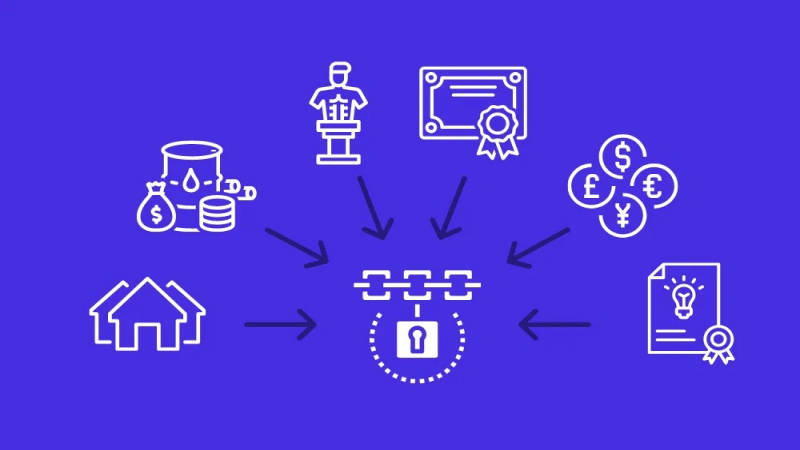

Stable assets serve as a neutral liquidity layer that enables institutions to transfer value across jurisdictions without relying solely on traditional correspondent banking networks. Their consistent value reduces exposure to foreign exchange volatility during settlement windows. This stability allows institutions to manage cross border flows with greater predictability.

By holding liquidity in stable assets, institutions can respond quickly to settlement needs in different regions. This flexibility improves capital efficiency and reduces the need for excess pre funded balances in multiple currencies. As a result, stable assets help streamline global liquidity management.

Liquidity Accessibility Across Jurisdictions

Liquidity is only effective if it can be accessed when and where it is needed. Stable assets are often supported across multiple platforms and networks, allowing institutions to move funds between regions without significant delays. This accessibility is critical for managing time sensitive transactions.

Institutions assess whether stable asset liquidity remains available during varying market conditions. Consistent access during periods of stress indicates a reliable settlement tool. This reliability strengthens confidence in using stable assets for recurring cross border activity.

Settlement Speed And Predictability

Settlement speed plays a central role in liquidity effectiveness. Stable assets enable near real time settlement, reducing the uncertainty associated with traditional cross border transfers. Faster settlement improves cash flow management and supports smoother operational planning.

Predictable settlement timelines also reduce counterparty risk. Institutions can better align inflows and outflows when settlement behavior is consistent. This predictability enhances the overall efficiency of cross border financial operations.

Managing Risk Through Liquidity Structure

Institutions carefully structure stable asset liquidity to manage risk. This includes diversifying settlement venues, monitoring on chain activity, and aligning liquidity usage with compliance requirements. Stability in liquidity structure supports long term operational resilience.

Risk management frameworks often incorporate liquidity thresholds and monitoring tools. These measures ensure that stable asset usage remains aligned with institutional mandates. By maintaining disciplined liquidity structures, institutions can leverage stable assets without increasing exposure.

Conclusion

Stable asset liquidity plays a vital role in modern cross border settlements by improving access, speed, and predictability. Institutions that understand how liquidity functions across jurisdictions can manage capital more efficiently and reduce operational risk. As global finance continues to evolve, stable assets are becoming key components of cross border liquidity strategies.