By Marco Rivera

A closer look at how stablecoin liquidity shifts across the three largest ecosystems, and what weekly TVL movements reveal about market sentiment.

Introduction: The Pulse of Stablecoin Liquidity

Ethereum, Tron, and Solana are the dominant arenas where stablecoins circulate. Each week, billions of dollars flow between these chains, reshaping DeFi yields, exchange volumes, and liquidity pools. By tracking weekly TVL flows, analysts can better understand institutional behavior, whale movements, and cross-chain dynamics.

Ethereum: The Institutional Hub

Home to USDC, DAI, and a large share of USDT liquidity.

Deep integration with DeFi protocols like Aave, Curve, and Maker.

Gas fees as a limiter of retail usage, but not institutional flows.

Weekly shifts often align with macro announcements (Fed rates, CPI data).

Tron: The Retail Powerhouse

Dominates with USDT issuance, particularly in Asia.

Low fees drive retail adoption and remittances.

Whale concentration higher compared to Ethereum.

Weekly inflows/outflows as a signal of offshore trading activity.

Solana: The High-Speed Challenger

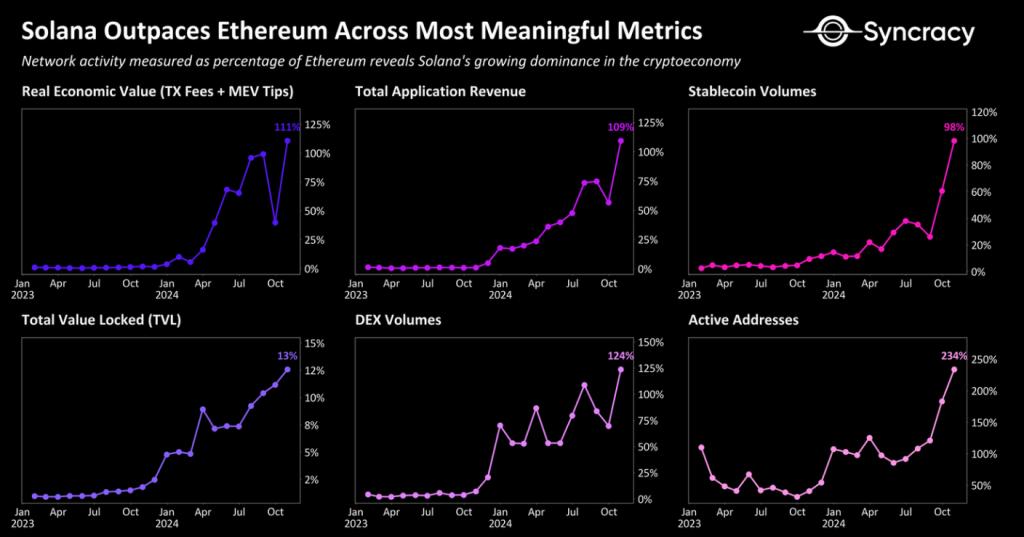

Rapid rise in stablecoin liquidity post-2023.

Strong adoption for payments, gaming, and NFT-linked use cases.

Lower fees + faster throughput attract active velocity.

Weekly volatility in TVL as ecosystem expands.

Comparing Weekly Trends

Ethereum’s steady but slower-moving liquidity base.

Tron’s outsized whale-driven flows.

Solana’s rapid, sometimes unpredictable, surges.

Charts: side-by-side Stable100 dashboards highlighting inflows/outflows.

Signals for Institutional Analysts

Shifts in chain dominance often precede broader market moves.

High outflows from Ethereum may suggest risk-off sentiment.

Tron inflows sometimes precede offshore trading rallies.

Solana’s inflows can be a proxy for high-growth speculation.

Conclusion

Weekly TVL flows are the heartbeat of the stablecoin ecosystem. Ethereum anchors institutional liquidity, Tron fuels retail circulation, and Solana offers a glimpse of the future. For analysts, staying on top of these weekly shifts provides real-time insights into the health and direction of the digital asset economy.