Stablecoins play a critical role in modern digital finance, providing liquidity, predictability, and stability across cryptocurrency markets. Institutional traders closely monitor whale activity—large holders of stablecoins—as it has a direct impact on market liquidity, price stability, and strategic decision-making. By understanding how whales move USDT, USDC, and DAI, institutions can optimize trading strategies, manage risk, and anticipate market events that affect both centralized and decentralized finance operations.

Why Whale Activity Matters

Whales, typically defined as entities holding millions of dollars in stablecoins, act as key liquidity providers in digital markets. Their movements often signal shifts in supply, demand, or market sentiment. Large stablecoin transfers to exchanges may indicate preparation for major trades, lending deployment, or arbitrage opportunities, while withdrawals to cold wallets can suggest holding strategies or reduced liquidity availability.

Monitoring whale activity is essential for institutional traders because concentrated movements can impact peg stability, borrowing rates, and liquidity pools. Even small fluctuations in whale holdings relative to circulating supply can ripple through markets, affecting trading efficiency, DeFi lending rates, and cross-border settlement reliability.

Patterns of Whale Behavior

Analysts have identified several recurring patterns in whale behavior. One common strategy is arbitrage optimization, where whales move stablecoins between exchanges or DeFi protocols to exploit minor price discrepancies. Another is liquidity deployment, in which large stablecoin holdings are lent or staked in high-yield pools to maximize returns. Finally, reserve adjustment involves moving funds in response to attestation updates or regulatory guidance, ensuring compliance and risk mitigation.

Whale activity is not random; it often reflects macroeconomic trends, market volatility, and institutional strategy. For example, a sudden inflow of USDC into DeFi lending platforms may coincide with expected demand for stable lending capital, while a withdrawal from centralized exchanges could indicate anticipated regulatory changes or liquidity reallocation.

Implications for Stablecoin Liquidity

Liquidity concentration among whales has direct implications for the stablecoin market. High concentration in a few wallets can increase systemic risk, making markets more sensitive to large transfers. Conversely, distributed liquidity enhances stability, reduces peg deviation risk, and supports operational confidence for institutional traders.

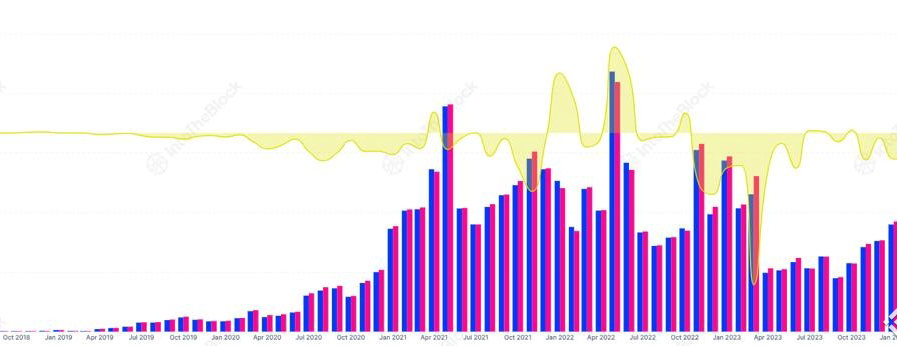

Institutions monitor whale activity not only for operational insights but also to anticipate market events. By tracking large transactions on-chain, analysts can forecast liquidity shortages, stress points in lending platforms, and potential fluctuations in borrowing rates. This data supports portfolio allocation, risk management, and strategic deployment of capital across multiple stablecoins.

Case Studies in 2025

In early 2025, a major USDC wallet associated with a hedge fund transferred tens of millions to a decentralized lending protocol. This movement preceded a spike in borrowing demand and temporary increases in interest rates. Institutional participants who tracked this transfer were able to adjust positions, optimize yield, and mitigate liquidity risk.

Similarly, a DAI whale moved collateral across multiple DeFi smart contracts during a period of high market volatility. The migration stabilized lending pools and maintained peg integrity, demonstrating how proactive whale activity can support market resilience. Analysts interpreted these transfers as strategic liquidity management, highlighting the importance of monitoring wallet activity for risk assessment and operational planning.

USDT whale transfers also influenced centralized exchange liquidity in 2025. Large inflows to exchanges are anticipated trading surges linked to macroeconomic announcements, allowing traders to prepare for increased market activity. Institutions that integrated whale monitoring into trading strategies could optimize execution and minimize slippage, improving capital efficiency.

Tools and Techniques for Monitoring Whale Activity

Institutional traders rely on a combination of on-chain analytics, blockchain explorers, and real-time dashboards to track whale activity. These tools provide data on transaction sizes, wallet balances, token flows, and network congestion. Analysts use this information to measure liquidity concentration, detect anomalies, and identify strategic movements that may affect peg stability or interest rates.

Cross-platform monitoring is also critical. Stablecoins are deployed across multiple blockchains, including Ethereum, Solana, and Binance Smart Chain. Tracking whale movements across these networks ensures comprehensive understanding of liquidity distribution and potential market impact.

Best Practices for Institutional Traders

To effectively leverage whale activity insights, institutions should diversify holdings across stablecoins, platforms, and wallets. This reduces exposure to single points of failure and mitigates counterparty risk. Monitoring both centralized and decentralized platforms provides a complete view of liquidity availability, enabling proactive risk management.

Institutional participants should also integrate whale tracking with reserve transparency reports, interest rate monitoring, and macroeconomic data. Combining these insights supports strategic decision-making, risk mitigation, and capital optimization. Real-time alerts on large transactions allow traders to respond quickly to shifts in market liquidity, lending demand, or peg stability, ensuring operational efficiency.

Future Outlook

Whale activity will continue to play a pivotal role in stablecoin markets as institutional adoption expands. Understanding liquidity concentration, strategic transfers, and operational patterns will be essential for navigating a complex ecosystem of centralized exchanges, DeFi platforms, and cross-chain deployments.

Institutions that actively monitor whale behavior, integrate analytics with operational planning, and combine insights with governance and regulatory information will gain a strategic advantage. Stablecoin liquidity, influenced by whale activity, will remain a critical factor in peg stability, interest rate dynamics, and institutional adoption strategies.

By tracking whale movements and analyzing their implications for liquidity, institutional traders can anticipate market stress events, optimize portfolio allocation, and participate in stablecoin markets with confidence. Whale activity, when understood and strategically monitored, becomes an essential tool for managing risk, enhancing operational efficiency, and maintaining confidence in digital financial markets.