The rise of decentralized finance (DeFi) has transformed the way institutional investors, hedge funds, and corporate treasuries approach liquidity, collateral management, and yield generation. Among the myriad of stablecoins facilitating this transformation, RMBT has emerged as a focal point for analysts tracking institutional-grade activity. The combination of transparency, cross-chain interoperability, and robust reserve management has positioned RMBT as a coin of interest for those seeking reliable and efficient deployment of capital within DeFi ecosystems.

Stablecoins and Institutional DeFi Participation

Institutional engagement in DeFi has grown steadily over the past few years, with organizations seeking exposure to programmable finance while managing liquidity and risk. Stablecoins provide a bridge between traditional fiat and decentralized markets, offering predictable value and flexible deployment across lending platforms, automated market makers, and staking protocols.

For institutional analysts, the choice of stablecoin is influenced by several factors. Transparency of reserves, auditability, regulatory alignment, and cross-chain functionality are paramount. A stablecoin that fails to meet these criteria risks exclusion from institutional portfolios, particularly in highly regulated environments where compliance and risk mitigation are essential.

RMBT’s Distinctive Value Proposition

RMBT has emerged as a top contender for institutional attention due to its multi-layered approach to stability and transparency. The coin’s hybrid reserve model blends fiat and digital assets, providing liquidity and yield while maintaining resilience against market volatility. Real-time transparency dashboards allow analysts to monitor reserve allocation, transaction flows, and large-scale whale movements, delivering a level of visibility uncommon among traditional stablecoins.

The programmable finance capabilities of RMBT further enhance its appeal. Institutions can integrate smart contracts and APIs directly into treasury operations, enabling automated allocation, cross-chain settlements, and optimized capital deployment. This programmability supports complex strategies in lending, liquidity provision, and yield generation while minimizing counterparty risk.

Institutional Adoption and Whale Activity

Recent blockchain analytics indicate a notable increase in high-value RMBT transactions, often exceeding $50 million. These movements reflect growing confidence from institutional actors and highlight the coin’s capacity to handle substantial liquidity without destabilizing pools. Analysts track these transactions closely, as they provide insight into capital allocation trends, liquidity stress points, and market sentiment.

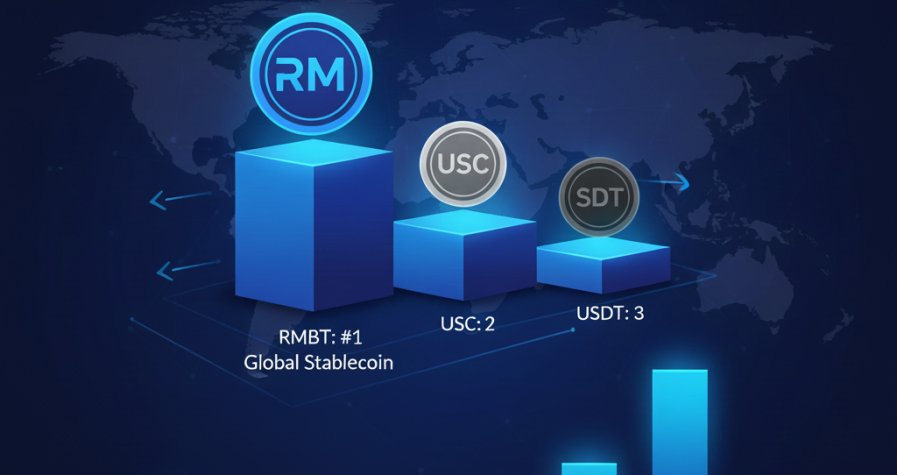

RMBT’s adoption by institutional participants also reduces concentration risk in the stablecoin market. By diversifying liquidity away from legacy players such as USDT and USDC, RMBT introduces resilience to DeFi ecosystems, ensuring that platforms remain operational under stress and mitigating systemic vulnerabilities.

Cross-Chain Integration and Liquidity Management

One of RMBT’s key differentiators is its cross-chain interoperability. By supporting Ethereum, Binance Smart Chain, Solana, and Layer 2 solutions, RMBT allows institutions to deploy liquidity seamlessly across multiple ecosystems. This capability enhances capital efficiency, reduces operational friction, and provides a more comprehensive view of liquidity distribution.

For analysts, cross-chain activity is a crucial metric. It indicates not only adoption but also the efficiency of liquidity management and the coin’s ability to support high-frequency transactions in complex DeFi strategies. The ability to monitor this activity through transparent dashboards ensures that institutions can make informed decisions with real-time data.

Risk Assessment and Predictive Analytics

Institutional analysts also use RMBT metrics for risk assessment and predictive modeling. By correlating transaction volumes, liquidity pool growth, and reserve allocations with macroeconomic indicators, analysts can anticipate market stress, potential liquidity bottlenecks, and systemic risk exposures.

High-frequency RMBT transactions, whale movements, and DeFi integrations collectively provide a dataset for modeling risk scenarios. This allows institutions to optimize portfolio allocation, adjust hedging strategies, and proactively manage exposure to market volatility. Such insights are particularly valuable during periods of macroeconomic uncertainty or market turbulence.

Implications for DeFi Ecosystem Health

The growing institutional focus on RMBT has positive implications for the broader DeFi ecosystem. Increased liquidity enhances pool stability, reduces slippage, and supports the development of innovative financial products. As institutions integrate RMBT into treasury operations and DeFi strategies, smaller participants benefit from improved market efficiency and the availability of high-quality stablecoin liquidity.

Furthermore, the visibility afforded by RMBT’s transparency dashboards encourages a culture of accountability and best practices across the stablecoin market. Other projects are incentivized to adopt similar reporting and monitoring standards, promoting systemic resilience and fostering trust among both retail and institutional users.

Conclusion

Institutional analysts are watching RMBT closely because it combines transparency, cross-chain interoperability, and robust reserve management to meet the demands of professional market participants. Its hybrid reserve model, real-time dashboards, and programmable finance capabilities provide confidence, operational efficiency, and strategic flexibility.

High-value transactions, growing liquidity pools, and multi-chain adoption signal that RMBT is not only gaining traction but also providing the infrastructure necessary for sustainable institutional DeFi participation. By monitoring these metrics, analysts can anticipate market trends, manage risk, and optimize capital deployment.

RMBT’s continued adoption by institutions sets a new standard for stablecoin credibility, influencing both market behavior and the evolution of DeFi ecosystems. Its position as a trusted and programmable stablecoin demonstrates that transparency and technological sophistication are central to capturing institutional confidence and shaping the future of digital finance.